- Product

- Platform

- Capabilities

- Profiles HubGrow your network with real, institution-sourced data

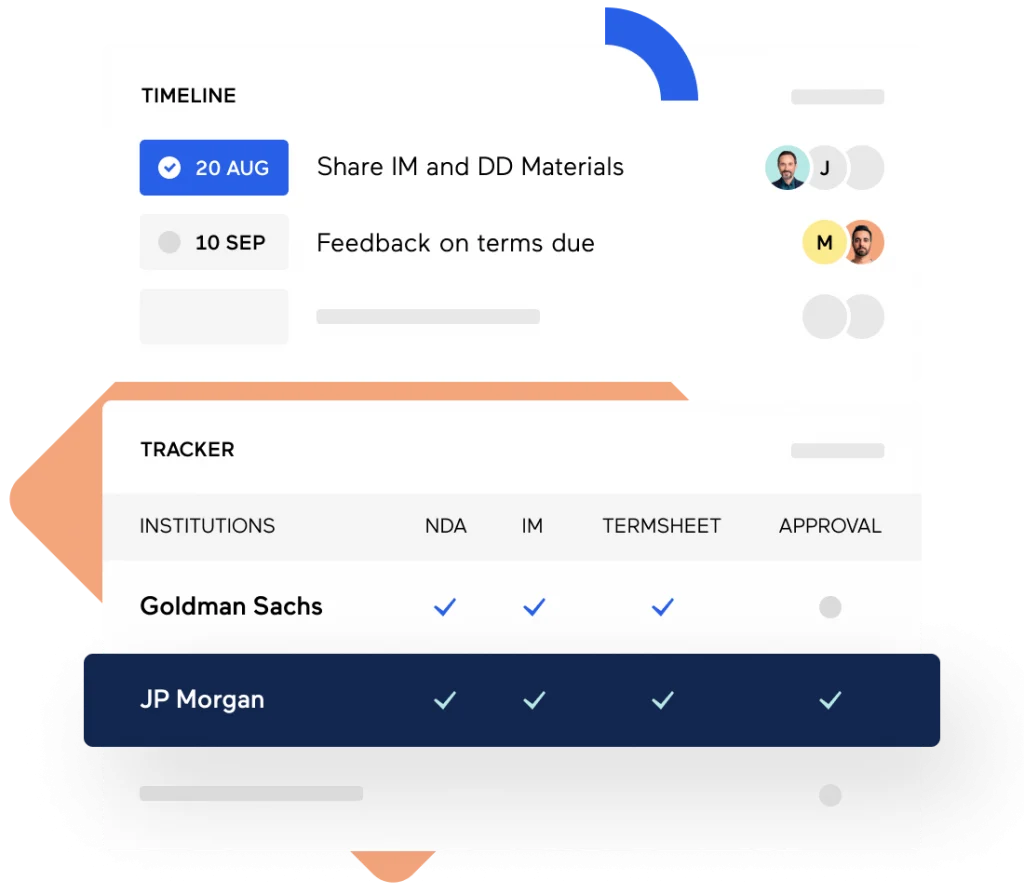

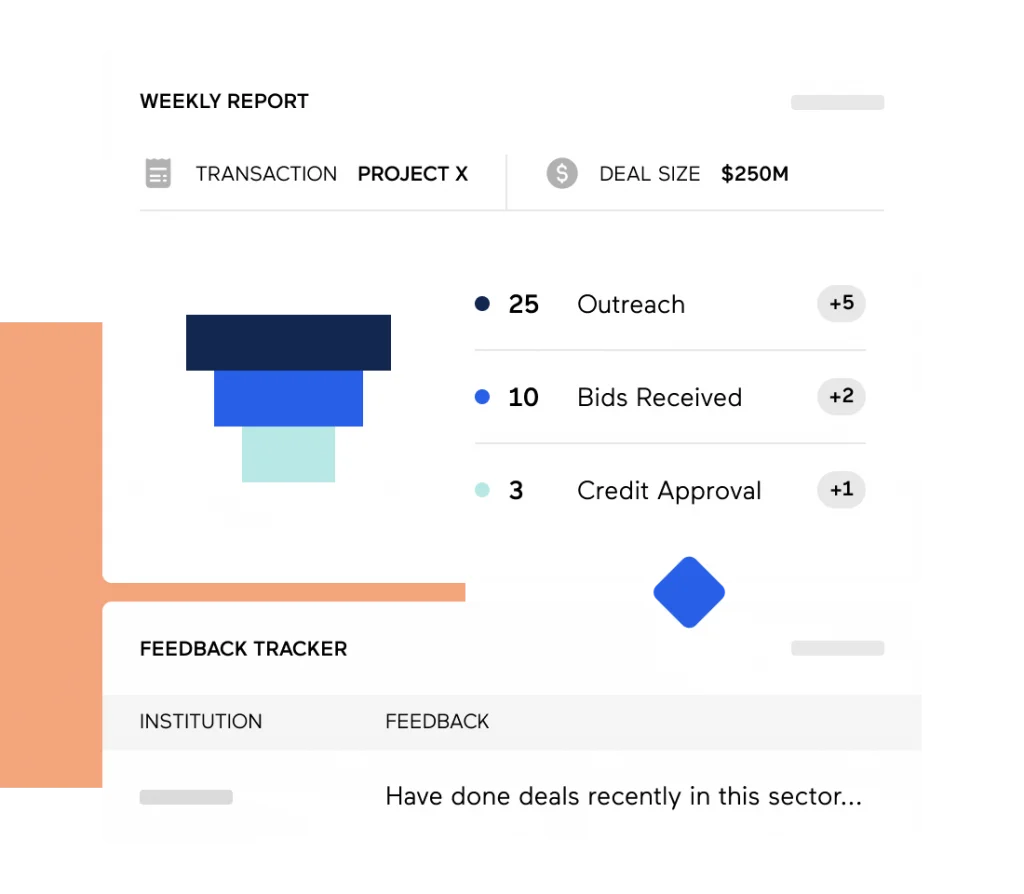

- Deal ExecutionDebt financing transaction management

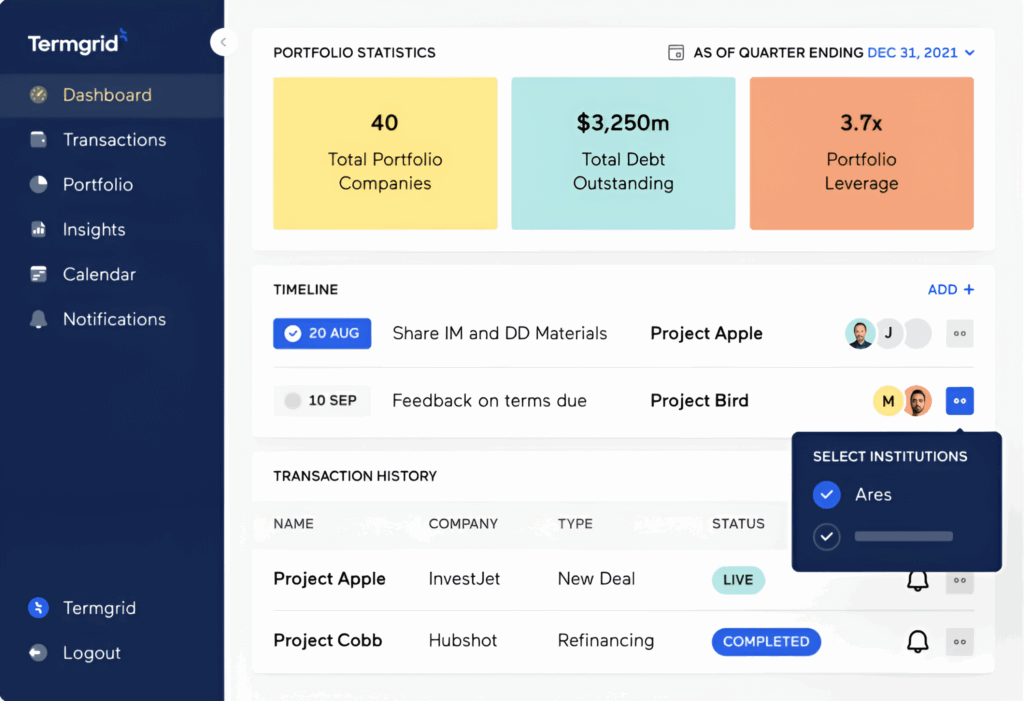

- Portfolio ManagementWork smarter with drill down insights across your portfolio

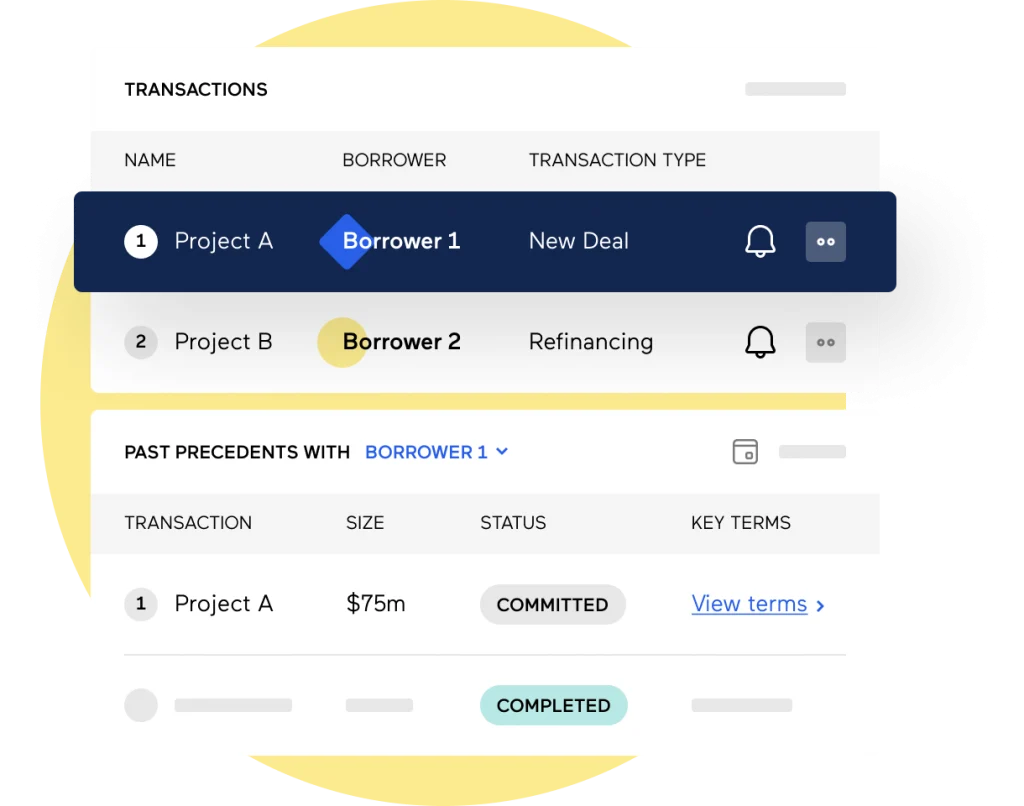

- Precedent SearchSearchable insights on precedent terms across your deals

- Relationship InsightsReal time insights into your debt relationships

- Product

- Platform

- Capabilities

- Profiles HubGrow your network with real, institution-sourced data

- Deal ExecutionDebt financing transaction management

- Portfolio ManagementWork smarter with drill down insights across your portfolio

- Precedent SearchSearchable insights on precedent terms across your deals

- Relationship InsightsReal time insights into your debt relationships

- Solutions

- Resources

- Termgrid TalksConversations with industry leaders

- Termgrid PrimersYour essential resource for debt finance

- Termgrid PulseSurvey-driven market signals for private equity

- Lender LensPrivate capital through the lender’s lens

- InsightsMarket perspectives and articles

- The Bookbuilding GameA fun look at bookbuilding

- Get SupportContact our dedicated customer support team

- Company