End to end platform for Private Capital Markets

Our end-to-end modular platform drives efficiencies across all transaction stages

Run your deal financing processes on Termgrid to streamline workflows and achieve greater efficiency

Active Users

Our clients represent a wide range of alternative asset managers

%

Capacity Enhancements

Your peers are saving one day a week by using Termgrid for their debt financing processes

Institutions

The largest network in private capital - ensuring you can connect with the right institution quickly and easily

Features

Deal Execution

- Accelerate deal execution

- Optimize transaction costs

- Save professional time

- Streamline collaboration between sponsors, lenders and advisors

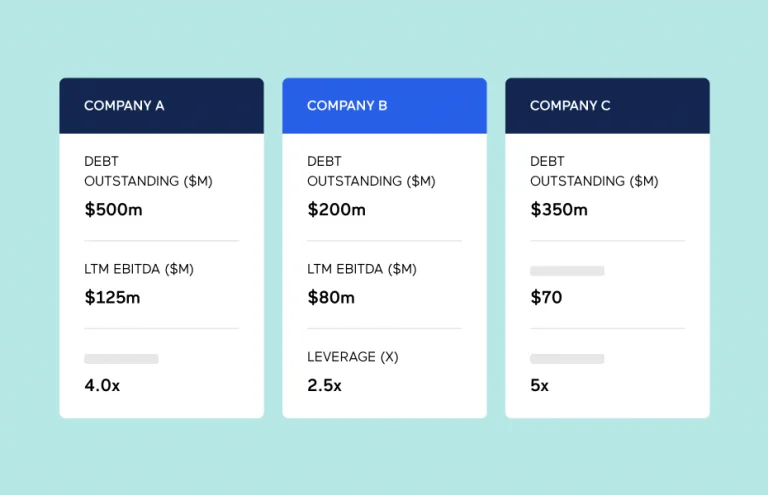

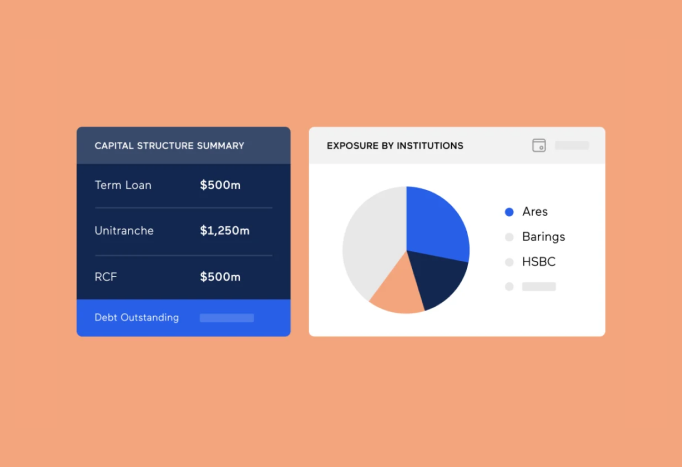

Portfolio management

- Centralized repository for all your debt portfolio data

- Manage consolidated capital structure

- Monitor covenants efficiently

- Automate routine reporting

Precedent Search

- AI-powered precedent search for key commercial terms

- Faster decision-making with institutional knowledge

- Holistic view of insights across all your debt deals

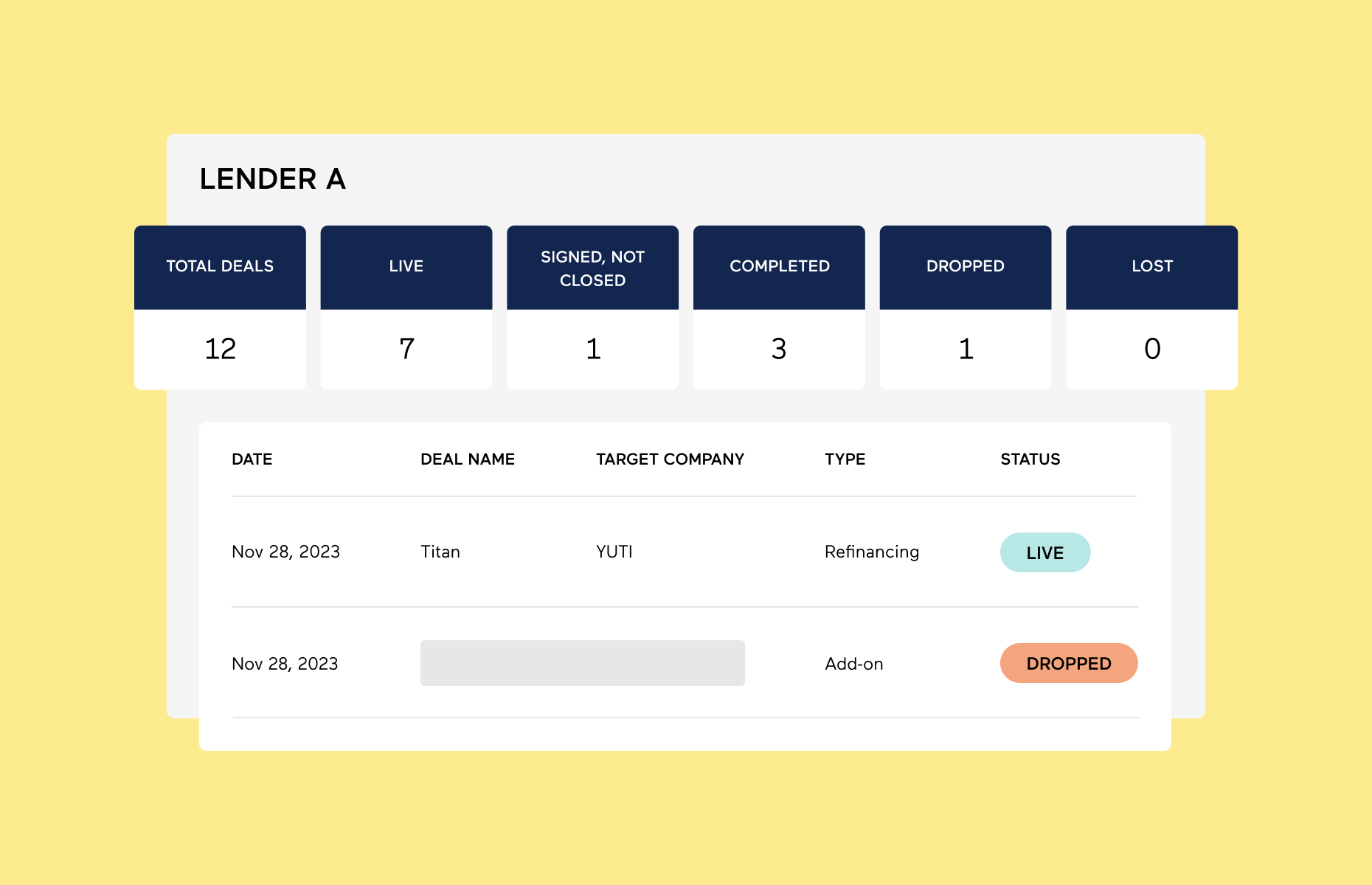

Relationship Insights

- Real-time insights into your private capital network

- Purpose built for private capital debt relationships

- Tailored to your workflows with automatic data capture

Featured Content

Termgrid Primers

We are delighted to announce the launch of Termgrid Primers, a new series focusing on debt financing best practices.

Written by Leveraged Finance and Capital Markets professionals, Termgrid Primers will provide practical tips on executing, coordinating, and closing private capital deals.

Ready to get started?

See how we can optimize your financing workflows