After a difficult couple of years, the clouds seem to be parting, at least slightly, for private capital markets. There is more optimism among investors and fund managers, with several tailwinds expected to boost the growth of the industry.

Growth of private credit beyond direct lending

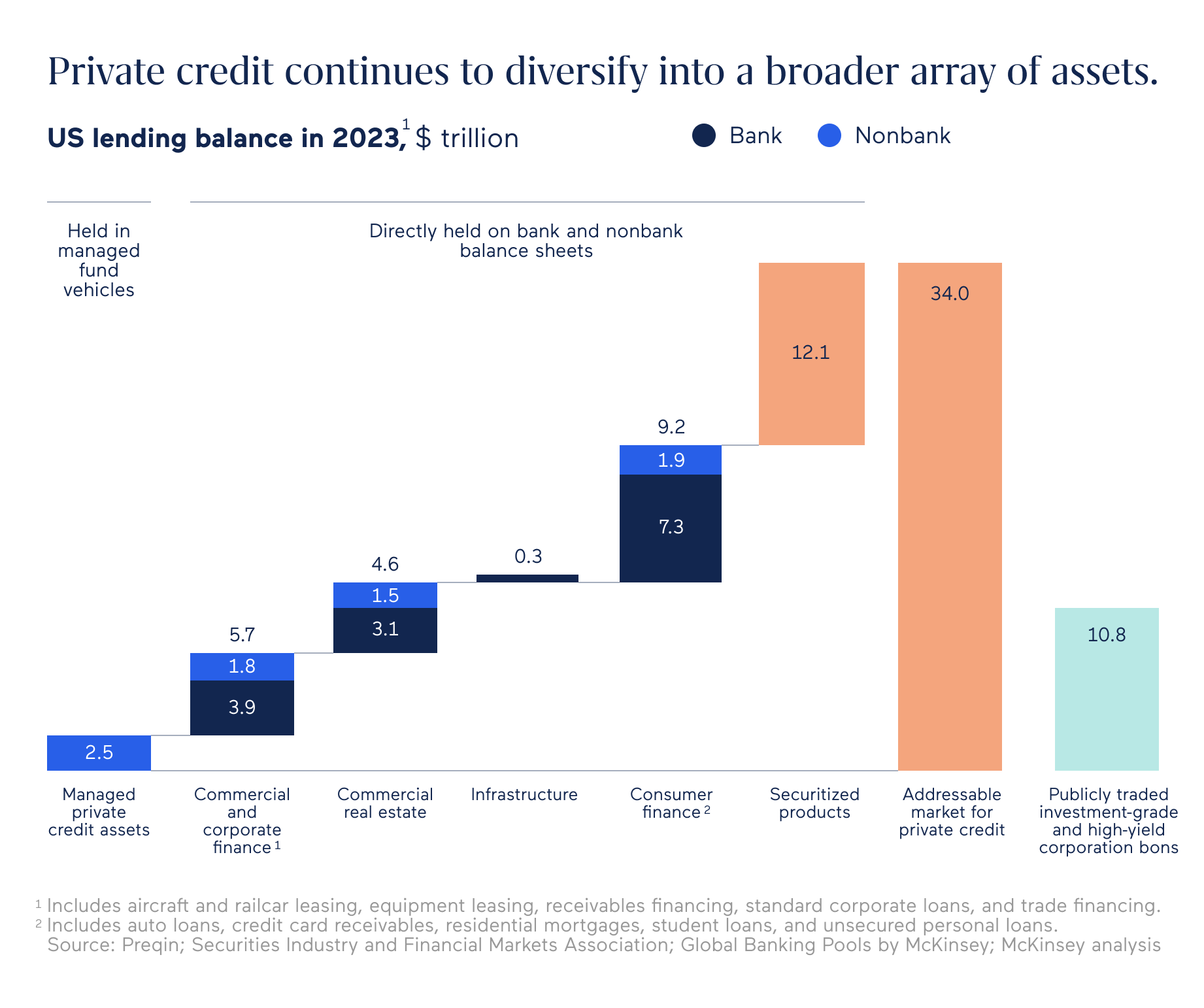

Direct lending continues to be the dominant asset class within private credit but other areas have been getting increased attention as investors look for ways to diversify, particularly in more mature markets like the US and Europe.

In a higher interest rate environment and slower deal market, private credit managers have started expanding into areas like asset-based lending. The strategy has gained interest from the largest asset managers to boutique players as direct lending has become more crowded and competitive.

In 2025, although rates are expected to continue to come down, private credit’s expansion into areas beyond direct lending will most likely continue. There is a big opportunity for funds in asset-based lending, with some focusing on areas like aircraft loans and equipment leasing.

Managers have also started looking more carefully at infrastructure and project financing to offer investors investments with longer duration.

Source: McKinsey

A McKinsey report found that infrastructure, asset-backed finance and higher-risk commercial real estate are among the asset types that are most likely to transition to non-banks, with the analysts expecting an additional $5tn to $6tn of such assets to shift over the next decade from banks.

Increase in deals

General partners across the private capital landscape are expecting a pick-up in dealmaking in 2025 after a sluggish 2024. Although fundraising has been slower than usual last year, the capital raised in previous years has been waiting on the sidelines ready to be deployed and the more favourable environment in 2025 should unlock some of that potential.

There are several factors that should lead to a rise in acquisitions. One overarching theme last year was that much of the world, including the US and the UK, were having elections, which meant a great level of uncertainty. Now that elections are over there is more certainty, particularly in the US. Meanwhile, the cost of borrowing has been coming down as inflation has decreased and central banks have started cutting interest rates. At the same time, the gap between the price expectation of buyers and sellers has been narrowing, potentially leading to more deals being agreed in the new year.

Deal numbers have already started picking up towards the end of the year, with the latest PitchBook data showing 5,137 private equity deals globally in the fourth quarter of the year, up from 4,327 in the first quarter.

Rise in co-investments

Limited partners are increasingly requesting co-investment options before they commit to investing in a fund, in an effort to maximise their returns. As fundraising continues to be challenging, GPs have become more accommodating and have increasingly been offering co-investment rights to get the first GP commitments locked in.

For example, Alaska Permanent Fund Corporation’s CIO Marcus Frampton told PEI that co-investments will play a significant role in its efforts to raise its private equity allocation to 18%.

This trend is expected to continue in the new year as LPs increasingly come back to the market looking for investment opportunities.

Digital transformation to continue

The private capital industry has been moving towards increased digitization for a few years now but it has been a slow transformation. However, the developments in automation, artificial intelligence and machine learning make it increasingly easier to streamline operations and evaluate data and private capital funds are realising the importance of digitisation.

More firms will look to implement technological transformations either internally or by outsourcing certain processes to experts. By automating some of the more manual and repetitive actions during a deal process, private capital funds can achieve up to 20% capacity enhancements, enabling them to focus on adding value to investments.

The push for private wealth

It is clear that the drive to increase access to private markets is not just a passing trend. According to Hamilton Lane, nearly 75% of private wealth investors were planning to increase their private markets allocations last year. And many have.

In the meantime, GPs have been focused on launching dedicated products for the private wealth channel, taking advantage of new structures like the recently revamped ELTIF regime in Europe.

GPs will continue to innovate in terms of new funds and solutions, while companies that provide services to the industry will update their business models to cater to a growing client base.

Private credit, seen as less risky and with the potential to provide regular income, has been a popular focus-area for new funds seeking capital from individuals. According to With Intelligence debt-focused ’40 Act funds’ assets grew to $400bn in Q1 2024, up 24.5% from 2023.

Wealth management allocations are expected to drive the next phase of growth for the industry overall.

With so many areas for innovation, it is clear that private capital is set for an exciting year in 2025. We will be monitoring these and other developing trends across the sector. Don’t forget to subscribe for updates.

Stay in touch with all of our latest updates and articles. Sign up now.