Private markets are inherently less liquid than public markets. Never has that lack of liquidity been felt more keenly than in the last few years where global headwinds have hampered IPOs and trade sales.

Faced with challenging liquidity, secondary deals are stepping in to offer an alternative.

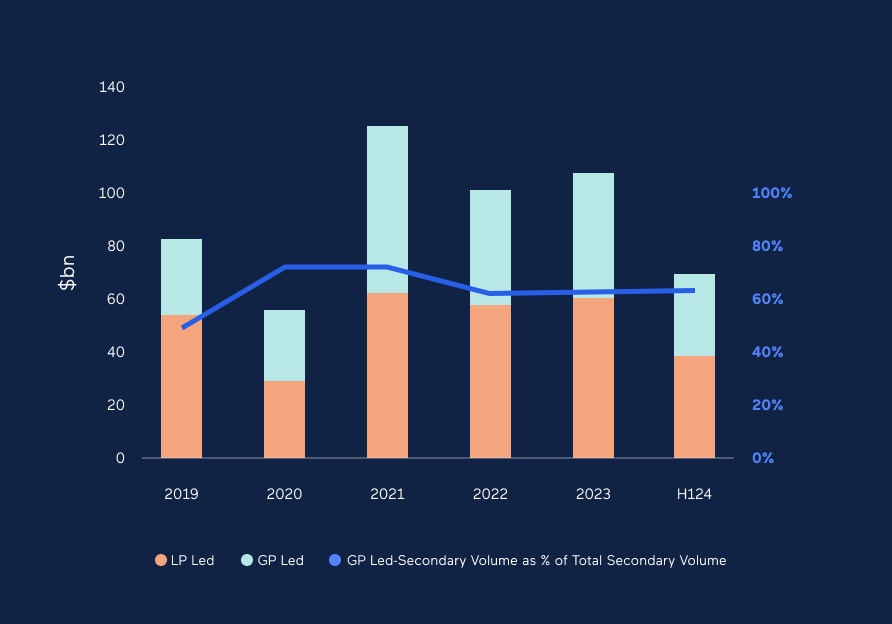

Whether or not the market hits the record highs anticipated, 2024 will be the fourth straight year of $100 billion-plus transactions in the secondary market.

In addition to a general growth of the market, there is a subtle – yet notable – change in the main protagonists with the shift from LP to GP-led transactions.

LP-led secondaries

Institutional investors selling their private equity stakes – albeit to a limited pool of investors – has been in existence for decades. Early transactions were of an ad hoc, bespoke nature offering liquidity in particular circumstances. By the 1990s, specialist funds had emerged to cater to this emerging market.

Since then, the secondary market has matured and provides a wealth of options for LPs looking to exit an investment, diversify their portfolio or simply manage the number of GP relationships they maintain.

The speed and efficiency of this market is evidenced by Lazard data showing that 82% of respondents were able to close transactions in under five months – in line with 2023 figures.

The survey also shows that portfolio management and liquidity are the main driver of transactions.

For buyers of LP portfolios, there is an opportunity to access mature assets with a clearer path to value creation and exit than a primary investment.

The growth of GP-led secondaries

Even more notable than the growth of the market is the change in the main protagonists. A decade ago, 90% of transactions were LP-led versus 10% GP-led. The market now sits closer to a 50:50 split with LP-led transactions roughly 55% of transactions.

Source: Lazard

And while LP-led transactions have been growing at a steady pace over the last 10 years, the GP-led market has seen double-digit growth in the last few years.

Far removed from their reputation as an end of life solution, GP-led secondaries round out the array of exit options with IPOs only available to an elite, a muted M&A market and refinancings or recaps picking up the rest.

“The advent of GP-led continuation funds is one of the most exciting legal innovations in a long time. It has become a fourth pillar for liquidity,” explained Blake Halperin, Partner, Proskauer.

“The LP-led market is still growing but its growth is pegged to the growth of the PE market, whereas this has a little more alpha in it and is showing that hockey stick growth.”

The shift from LP to GP is also linked to a change in the nature of the transaction.

Self select

In comparison to the hundreds of assets contained in an LP portfolio, GP-led transactions are far more concentrated and can even be a single asset. This offers a highly focused investment opportunity to buyers looking to customize their exposure to sectors or deal sizes.

Buyers are paying a liquidity premium that is reflected in the discount – or lack thereof.

While most deals price at a discount, Lazard figures show that roughly 90% of single asset continuation funds were priced at 90% or above. This compares with 78% in 2023.

The same survey shows that 69% of multi asset continuation vehicles achieve this 90% price level, up from 59% in 2023.

While this ability to select investment exposure is attractive, it can also entail more due diligence and monitoring to manage portfolio risk as a whole.

Visibility into value creation

GP-led transactions continue to grow into their role as an important source of liquidity in the market. The option for an exit may be viewed differently by a sovereign wealth fund which has an evergreen profile compared to an insurance fund with fiduciary obligations.

Should an LP choose to reinvest, they are investing in a known entity with an existing track record.

“Sponsors do have deeper knowledge of their existing assets, which they may have held for a number of years. Reinvestment by the sponsor demonstrates strong conviction in the management team and the strategic direction of the business,” explained Warren Allan, Partner, Proskauer.

This also highlights one of the inherent risks in the deals – managing the role of GP as both buyer and seller. As the market continues to develop there is a developing concept of best practice which includes a minimum 20-day election period for selling funds to consider the deal and parity of information between sellers and buyers. For more detailed guidance ILPA has published its best practice here.

Capital constraints on growth

At the end of the first half of 2024, dedicated available capital, including near-term fundraising, was estimated at $253 billion.

But the amount, or the level of flow that is coming out in terms of opportunities into the secondaries market is far outpacing the amount of buy side capital available, as one banker explained.

“In 2017, $58 billion of deals were completed in the secondary market and another $10 billion worth of deals that did not complete but came to market.

“Today, there’s over $100/120 billion worth of deals. But large secondary buyers told us last year that they’ve seen around 60 billion worth of deals in 2023 alone that came to market but failed to complete. So that ratio was 60:10 but today is 100:60. That’s a huge change”.

The shortfall is in capital, rather than quality.

Stay in touch with all of our latest updates and articles. Sign up now.