Amid ongoing global uncertainty, M&A activity has slowed, and private equity fundraising has dropped to its lowest levels since 2016. As the challenges of raising new funds and closing deals persist into the second half of 2025, large-cap private equity firms are increasingly turning to the middle market for opportunity, according to a recent study by Termgrid.

Explore the full findings below to see how private capital is navigating change — and preparing for what’s next.

Please complete your details here to receive the full results by email. Or continue to read on the page below.

This shift down market isn’t surprising. The middle and lower-middle market segments have historically been more insulated from global economic volatility, making them more attractive in uncertain times. But insulation alone isn’t driving the move. Larger firms are also motivated by reduced competitive pressure and limited deal flow (36%), as well as the desire for broader market exposure (41%).

More than 75% of large-cap firms surveyed view the middle market as a space for growth and expansion. Notably, middle and lower-middle market respondents expressed a more optimistic outlook on private markets for the remainder of 2025 than their large-cap counterparts. Over 60% of mid-market respondents reported optimism about market conditions, compared to fewer than 50% of large-market participants.

“In many respects, overall M&A activity has had a series of bad breaks over the past few years, including the effects of COVID,” says Meredith Laitner, partner and co-head of the M&A Group at Ellenoff Grossman & Schole LLP, a New York headquartered law firm. “Many transactions have continued to stop and start during the first half of 2025 as market conditions globally have continued to change. There are a lot of larger, stalled deals out there.”

She adds that not all sectors are equally affected. “AI, technology, and crypto transactions are still moving forward, and strategic acquirers remain interested. Private equity firms are holding onto higher-value assets for now, which isn’t surprising. I’m looking forward to more stability—then we’ll see the larger deals return.”

Regional Sentiment and Market Drivers

Positive sentiment remains strongest in the Americas, where 59% of respondents have a positive outlook for the rest of 2025. Improved economic conditions were cited as the top driver of increased deal flow (47%). In contrast, only 34% of respondents in EMEA cited the economy as a key driver, with 32% also pointing to pressure to return capital to LPs.

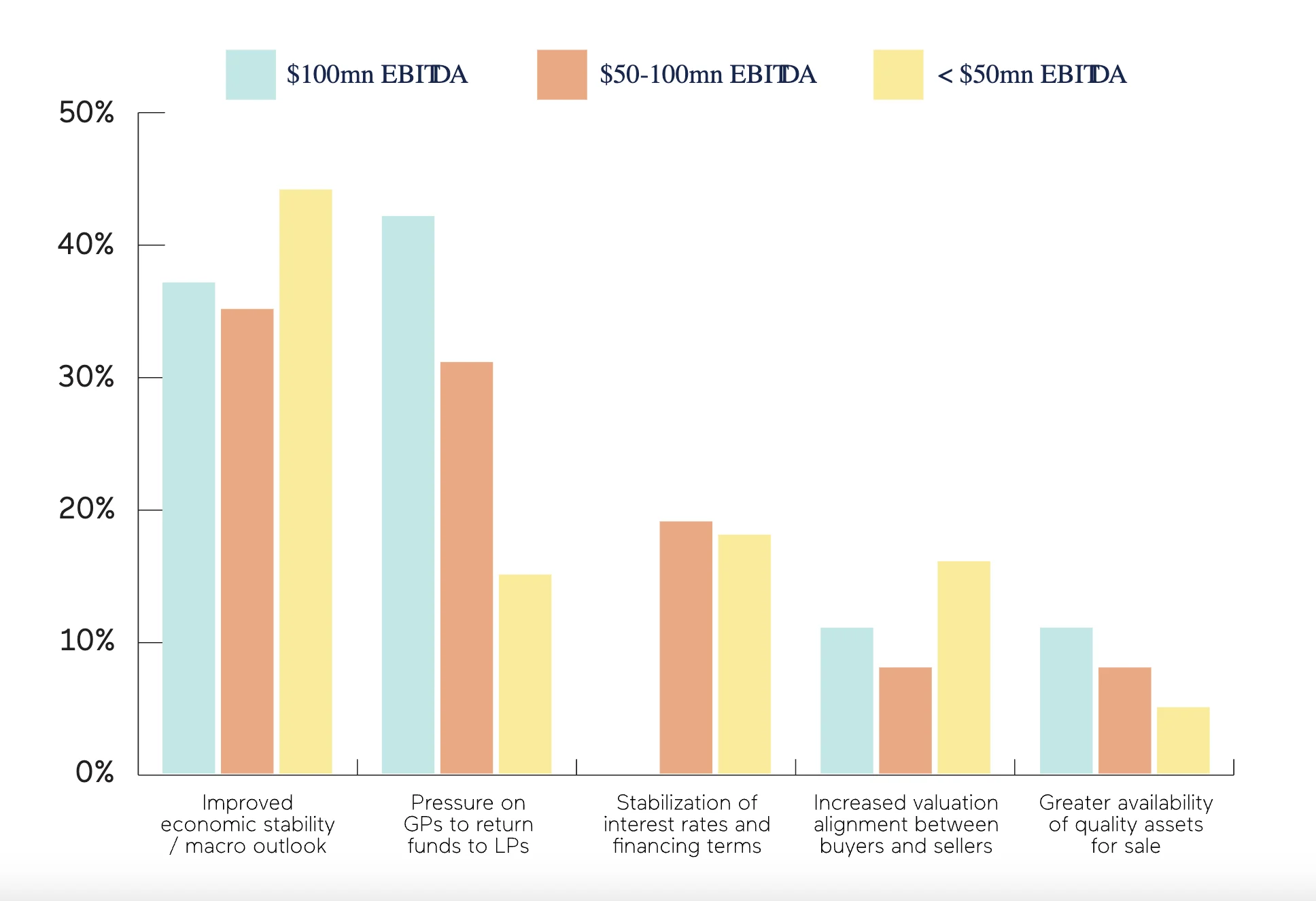

Across regions, the key macroeconomic factors influencing M&A include economic stability, interest rate normalization, and pressure to return capital to LPs. Lower-middle market firms report being significantly less impacted by these pressures. For instance, over 40% of firms with more than $100 million in EBITDA cited LP capital return pressure as a major M&A driver, compared to just 15% of firms with under $50 million in EBITDA.

Overall, respondents agreed that economic stability would have the greatest positive impact on M&A activity, followed by stabilized interest rates, better valuation alignment, and more assets coming to market.

Fundraising Outlook

Fundraising remains a challenge across the board. Over 60% of all respondents expect the fundraising environment to be difficult over the next 12 months, with fewer than 20% anticipating improvement.

The sentiment is especially negative among upper-market firms—70% expect continued headwinds, versus under 60% of lower-middle market respondents.

“Until firms are ready to divest assets, fundraising will remain slow,” Laitner explains. “I don’t see that changing for a while.”

Despite the overall slowdown, LP appetite for co-investment opportunities remains strong, particularly in the mid and lower-middle markets. LPs view co-investments as a way to enhance economics and gain selective exposure to deals with less sensitivity to macroeconomic trends.

“It’s not surprising that co-investments remain an important strategy for LPs,” Laitner says. “Now that co-investments are widely offered by private equity firms, I don’t see that changing. It’s a great way for LPs to diversify and gain exposure to different industries. Co-investment should continue to grow in popularity.”

Evolving Deal Terms

As large-cap firms enter the middle market, they’re also bringing their deal terms with them. Mid-market deal structures are seeing looser covenants and more flexible documentation, mirroring trends previously limited to the upper market. Over 17% of respondents say looser deal documentation is now widespread.

Key negotiation points include EBITDA adjustments, debt-to-leverage ratios, and payment restrictions. Notably, these trends are more prevalent in Europe, where lenders have been more flexible. In contrast, U.S. lenders remain more conservative.

The Role of Technology

Technology continues to play a growing role in M&A execution. Adoption began with large firms, but pressure is mounting for middle-market players to innovate. While Excel remains a standard tool, more firms are turning to platforms like Termgrid to manage and track deal terms with greater efficiency.

Digitalization is helping streamline processes and reduce administrative burden—an increasingly important differentiator in today’s competitive environment.

Overall, while the broader private equity landscape continues to face headwinds, the middle and lower-middle markets are emerging as relative bright spots. With more manageable macro pressures, a steady flow of co-investment interest, and increased tech adoption, these segments may continue to attract capital and drive deal activity through the remainder of 2025.

About the survey

Select private capital professionals were invited to take part in the survey in June 2025. The results reflect a broad range of views drawn from the Americas (53%), EMEA (44%) and APAC (3%).

Survey respondents reflect a broad array of private capital participants including sponsors (37%), private credit funds (29%), bank lenders (13%) and advisors – including debt advisors, law firms and corporate finance boutiques totalling 21% of respondents. Respondents from sponsor and private credit firms reported their assets under management as follows: over $10 billion (42%), $5–10 billion (11%), under $5 billion (39%), and evergreen structures (8%).

Stay in touch with all of our latest updates and articles. Sign up now.