In a year marked by economic uncertainty and fundraising friction, private capital firms are adapting — and evolving. Termgrid’s 2025 Private Capital Sentiment Survey captures the latest insights from leading sponsors, credit funds, lenders, and advisors across the Americas, EMEA, and APAC.

What’s driving dealflow? Where are LP expectations shifting? And how is technology reshaping the way capital is raised, deployed, and tracked?

Explore the full findings below to see how private capital is navigating change — and preparing for what’s next.

Please complete your details here to receive the full results by email. Or continue to read on the page below.

Introduction

With 18k+ deal participants across 1,100 institutions using the Termgrid platform to run or participate in financing processes, Termgrid stis at the center of the private capital community.

We regularly speak to our audience or private equity sponsors, lenders and advisors to capture sentitment on the market.

Our H2 2025 survey focus on

- Market Outlook

- Mid Market Focus

- Evolving Deal Terms

- Technology Adoption

Methodology

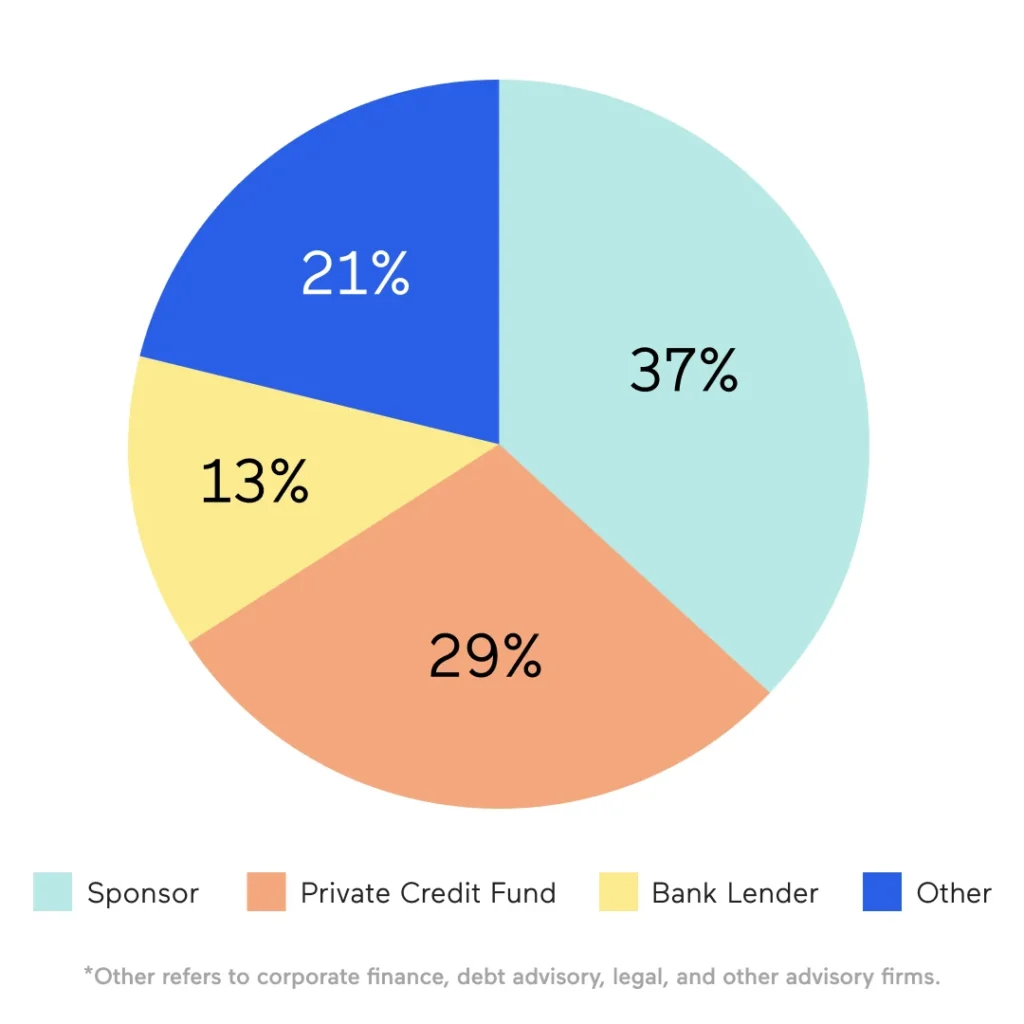

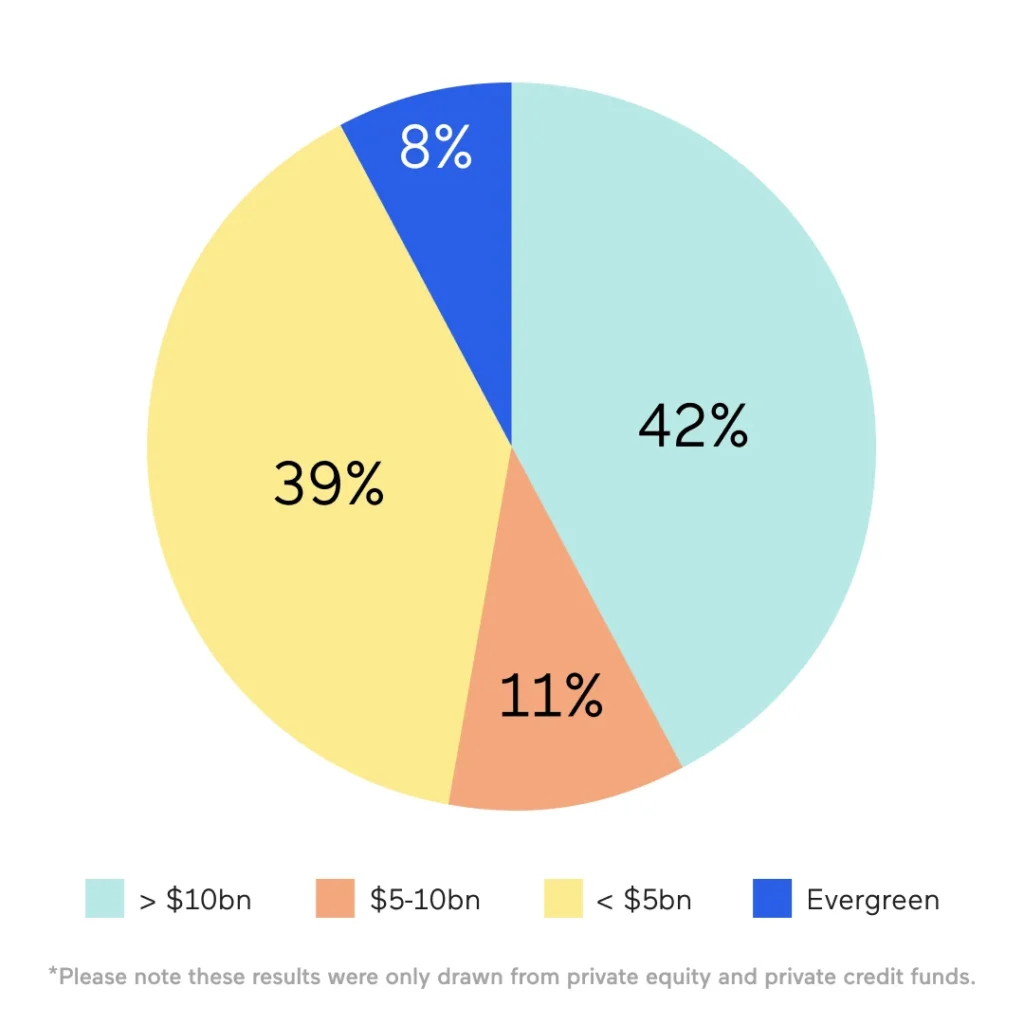

Survey respondents reflect a broad cross-section of the private capital community.

Where are you based?

What size company do you typically work with?

What type of firm do you work for?

What is the size of your fund?

Market Outlook

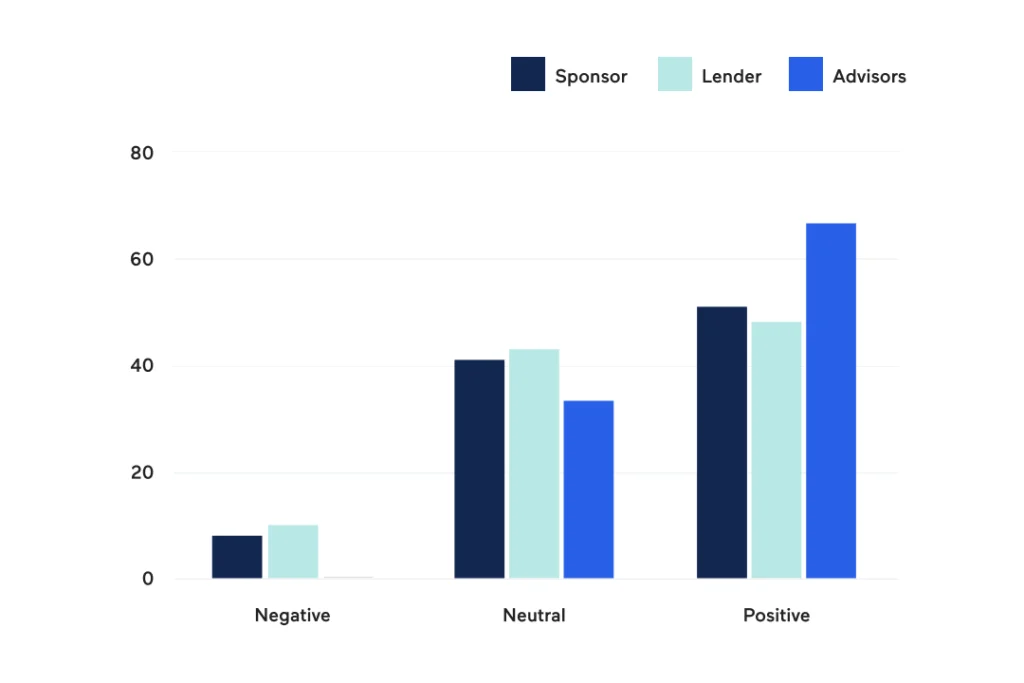

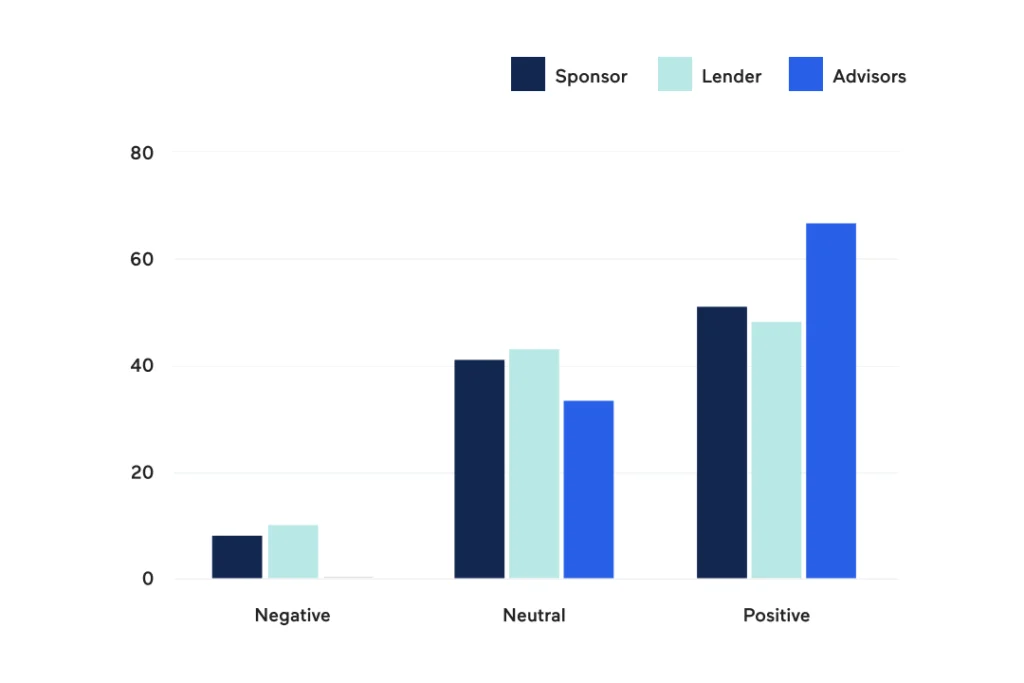

What is your general outlook for private markets for the remainder of 2025?

H2 2024

H2 2024

H2 2025

The findings are consistent with those from H2 2024, where overall optimism stood at 52%, closely mirroring this year’s figure of 53%. This stability underscores the private capital sector’s resilience – demonstrating its continued ability to identify innovative capital deployment strategies, explore new markets, and leverage advancements in the secondary market.

Which of the following factors will have the biggest impact on driving M&A?

Underlying the higher sentiment in the Americas, an improved economy is seen as a driver of dealflow (47%). An improved economy is cited by just 34% of those in EMEA, alongside pressure to return funds to LPs as a driver of deals (32%).

How do you see the fundraising environment over the next 12 months?

Challenging fundraising conditions are still expected by sponsors in the near term. However private credit players expect an improvement on their side, which generally sees healthy demand in times of volatility.

Are you seeing an increase in co-investment opportunities?

While fundraising remains challenging, appetite for co-investments shows no signs of slowing down.

In fact, demand is surging – particularly in the mid- and lower-mid market where investors see co-investments as a rare opportunity to gain targeted exposure, enhanced economics, and greater deal-level insight.

What do you see as the main value creation drivers in private equity-backed companies?

M&A continues to be seen as the primary driver of value creation in private equity-backed companies, underscoring its central role in buy-and-build strategies and growth acceleration.

As inflation erodes the impact of cost savings, reducing costs may have become a less powerful value driver. In contract, focusing on revenue enhancement has become more compelling – particularly as pricing power and top-line growth opportunities tend to be more accessible in an inflationary environment.

Mid Market Focus

Do you anticipate interest from large-cap firms in mid-market opportunities?

Sponsors and Advisors have their eye on the prize – and it’s the mid-market. Expect plenty of action in this space heading into the second half of the year…

We have multiple fund strategies and our portfolio evolves over time depending on market dynamics. Currently we’re seeing more compelling opportunities in the middle and lower middle market space.

Global Private Equity Investor

Which of the following factors will have the biggest impact on driving M&A?

…but it won’t be plain sailing – economic headwinds, rate sensitivity and valuations remain points of contention.

Evolving Deal Terms

Looser documentation is now common in large cap deals, to what extent do you see the trend extending into the mid-market?

Covenants have long been in the cross-hairs – debated, diluted, and ultimately dropped in larger deals.

Ultimately the direction of documentation terms will be driven by liquidity. With subdued M&A activity and strong LP demand for deployment, lenders may accept looser terms to secure their share of available deal flow.

The mid-market is no longer immune. Deal terms are loosening here too, suggesting that the trend towards weaker covenants is more widespread than expected.

EBITDA adjustments (aggressive, often uncapped add-backs), ratio-based baskets with “greater of” formulations, and increased incremental debt capacity

Mid Market Private Credit Fund, Europe

Significant ability to incur additional debt – restricted vs. unrestricted subsidiaries, restricted payments flexiblity, debt incurrence (ratio / basket headroom, sidecar debt flexibility)

Mid Market Private Credit Fund, Europe

Mostly everything is cov lite now

Mid Market Private Equity Fund, Americas

Recently got a cov-lite private credit unitranche on a middle-market sized deal, with no amortization at all (not even 1%)

Global Private Credit Fund, Americas

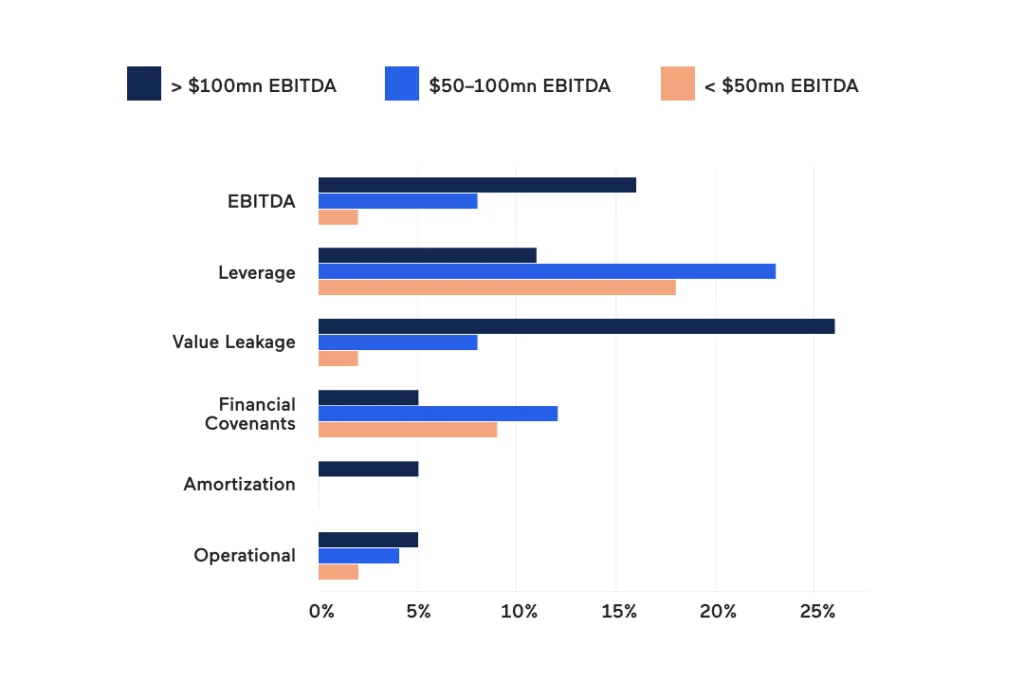

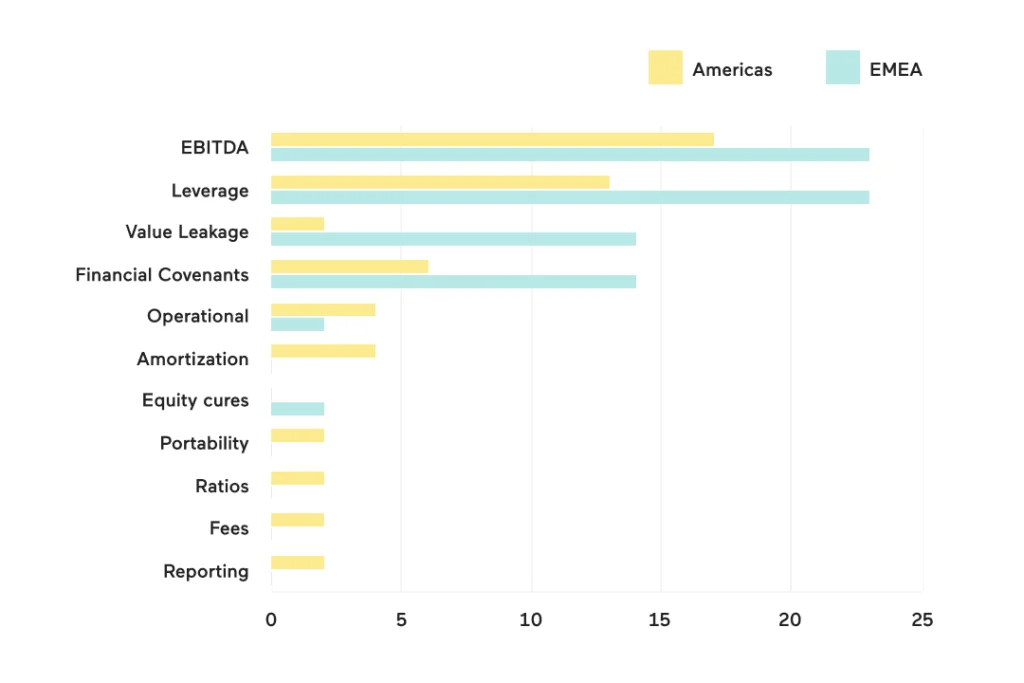

Which areas of the covenant package have loosened most?

Which areas of the covenant package have loosened most?

Technology

How would you characterize your firm in terms of technology adoption?

Innovation becomes more challenging in large firms but there are still many early adopters and early majority among the large caps.

Mid market funds may feel the pressure of time and cost more keenly when trying to adopt new policies.

While excel remains the industry-standard, forward-thinking innovators and early adopters are increasingly turning to Termgrid to track and manage deal terms more efficiently.

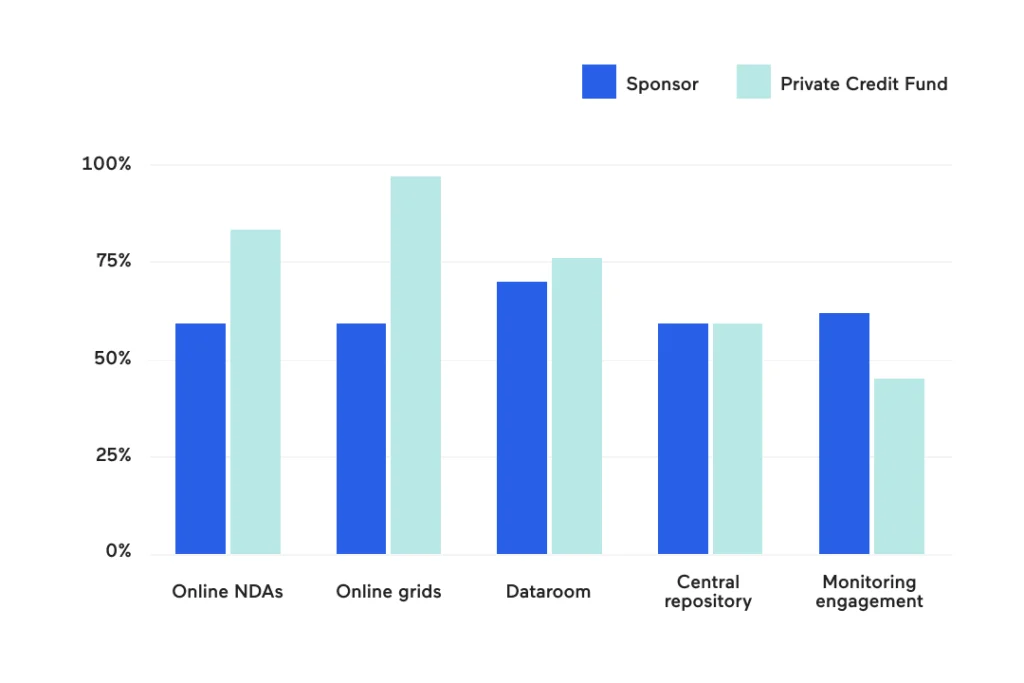

Where can technology have an impact on deal processes?

Technologies often seen as Sponsor-led initiatives are, in fact, highly valued by Lenders – sometimes even more so.

Digitalization streamlines processes and reduces the administrative burden for all parties across the transaction.

Find out more about Termgrid’s technology offerings in Deal Execution, Portfolio Management, Precedent Search and Relationship Insights.