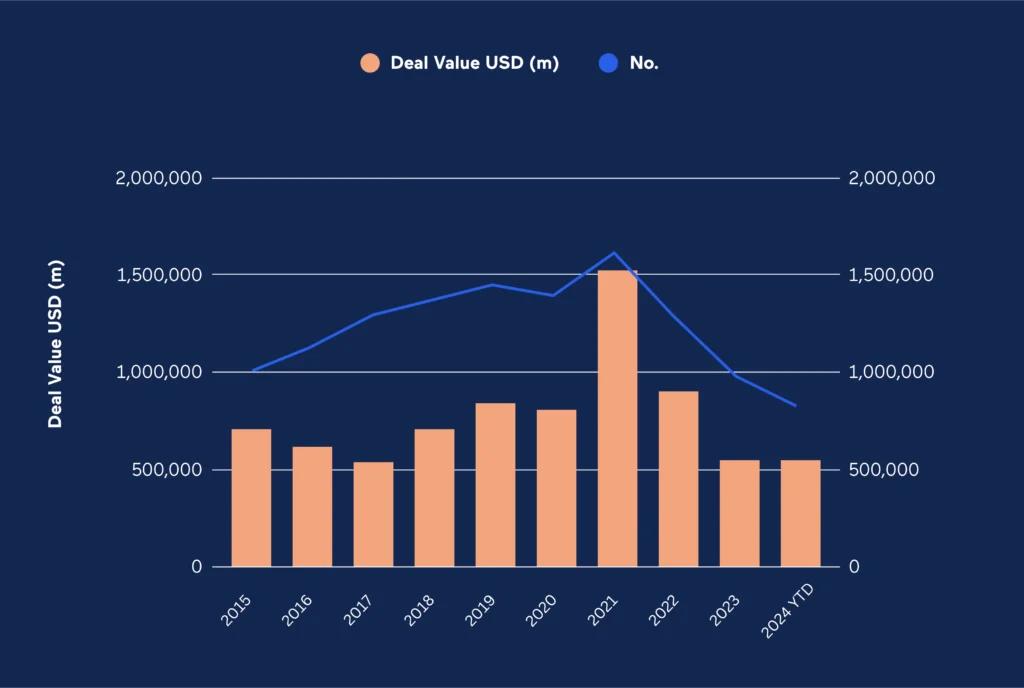

According to Mergermarket data, total global investment in transactions across all sectors fell by almost half between 2021 and 2023. And the technology sector bore the brunt – falling to not much over a third of the $1.5trn level it had achieved just two years before.

But to focus on those numbers is to ignore a sector which according to the same data attracted more investment than any other for each of the last five years. And by October of this year total investment in global technology deals had already reached $546.4bn, almost surpassing total investment in the sector for all of 2023.

Source: Mergermarket, figures correct as at 30 October 2024

Market practitioners, though, are still cautious and tend to talk more about a gradual clawback against a market background made uncertain by key elections and budgetary decisions in Europe and the US and wider turbulence.

“The market is better than six to twelve months ago but it has not reached the peak it was at before the collapse of valuations after 2021,” says one European technology banker. “The tech market is very sensitive to the overall interest rate environment and with interest rates going down this will have a disproportionately higher impact on the industry. We haven’t quite come back to 2019 but we are better off.”

Public to private

While listing activity has started to pick up and there is some expectation this will gather pace in the new year, market participants point to a perceived lack of liquidity in the public markets as a particular problem for many companies in the technology sector.

“Below a certain threshold institutional investors are not prepared to invest in the quoted market and this is driving a lot of public to private deals,” the European technology banker says. “Stock markets are not really servicing smaller mid cap companies very well. Valuations go down and there is no buyside interest from traditional stock market investors and this is where private equity pounces.”

And while some of the sector’s biggest deals so far this year have included public to private (P2P) transactions like technology-focused private equity group Thoma Bravo’s $5.3bn acquisition of cybersecurity Darktrace, state-backed French lottery operator Française des Jeux’s €2.6bn ($2.8bn) acquisition of Stockholm-listed gambling group Kindred and the completion in October of an EQT-led £2.2bn ($2.8bn) acquisition of AIM and London-listed video games and entertainment technology provider Keyword Studios, few believe there has been a remarkable trend in the more active mid-market towards P2P activity.

Buyer growth expectations, one technology sector adviser says, are not always being met. And it is this which is at the heart of the dilemma for tech investments. A sector which has traditionally been sold on growth potential alone now needs to have a more compelling story.

The extent to which growth, or the perceived lack thereof, has been holding back technology transactions can be better seen in the much more active private markets.

Growth has been particularly difficult for the IT services sector whose companies are often more exposed to cuts businesses feel they have to make in their discretionary spending.

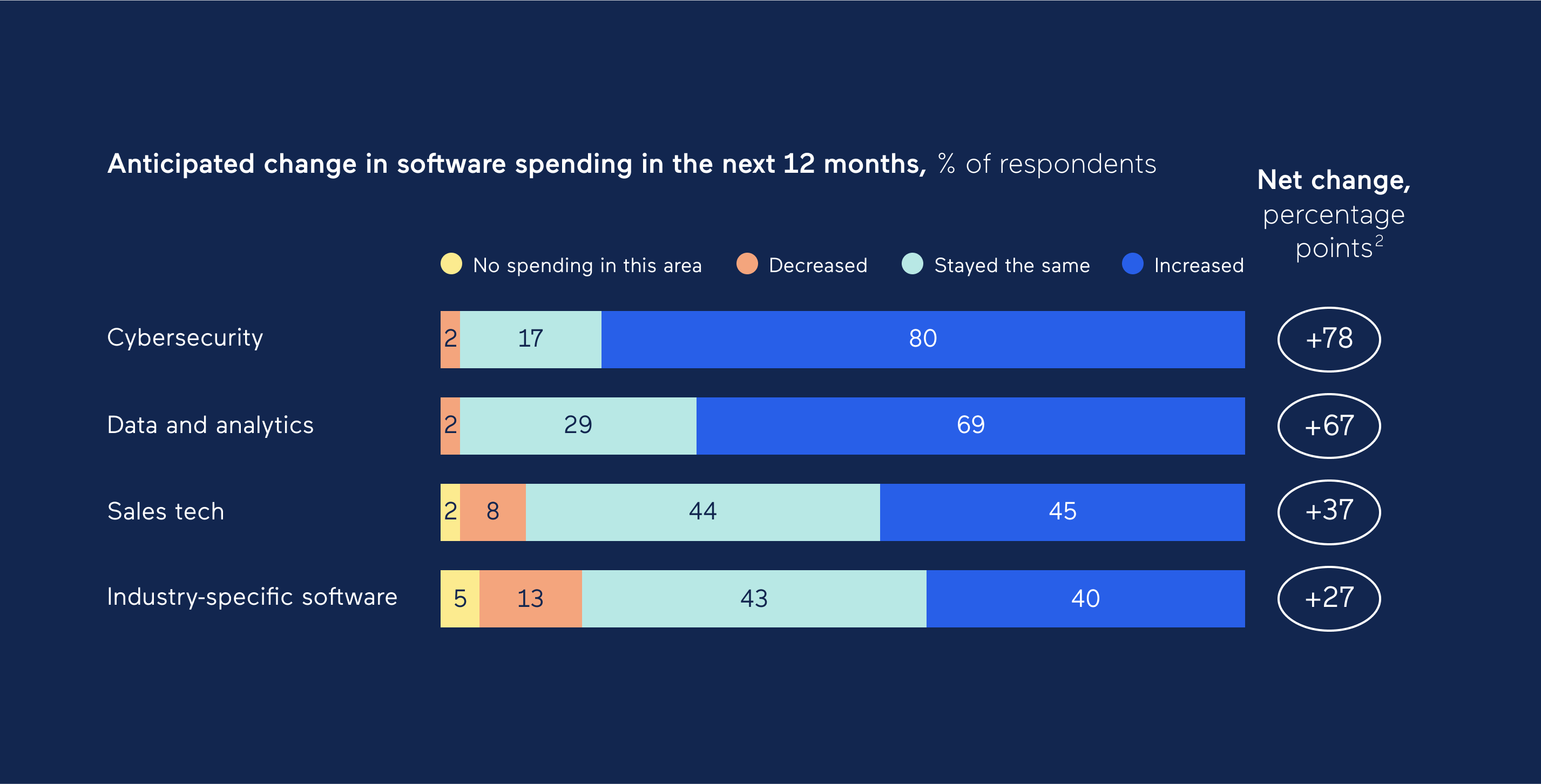

While the macroeconomic environment has undoubtedly weighed on overall spend, it would be easy to miss the nuances among the headline figures. A McKinsey report suggests CIOs are still expecting to increase overall spend on IT with cybersecurity; data and analytics; sales tech and industry-specific software showing the biggest increases.

Source: McKinsey

There are bigger growth stories underpinning the tech sector such as SaaS, digitalization and Gen AI. There are also bright spots among the sub sectors such as medical and financial software as well as an IT services consultancy market that is still ripe for consolidation.

Meanwhile strategics like Accenture, which had made several specialized acquisitions at high multiples, continue to be active buyers in the technology space.

Value versus growth

Having relied on growth for so long, tech investors are now having to grapple with more fine-tuned value creation strategies focused on higher margin products, regions or services.

Lower valuations have also opened the door to more traditional buy and build strategies, corporate carve outs and public to privates.

The technology sector then seems set to continue its lead of market activity into 2025 but the story is more nuanced than it has been in the past.

Stay in touch with all of our latest updates and articles. Sign up now.