We are delighted to announce the launch of Termgrid Primers, a new series focusing on basic topics on the debt financing process.

Written by Leveraged Finance and Capital Markets professionals, Termgrid Primers will focus on practical tips and best practices for executing, coordinating and closing debt deals in the sub-investment grade space.

We are delighted to share the full article below. However, if you would like to fill in the form we will email you with the full report to read at your leisure.

This is the first in the series, so signing up will ensure that you get emailed directly with all of the following episodes.

Series 1: The Debt Financing Process

Episode 1.1: Debt financing for LBOs or M&A – from Kick-off to Signing

As any finance professional knows, an M&A process involves a multitude of workstreams. Once a target company is identified, this kicks off a complex process, involving appointing and managing advisors, determining how the transaction will be financed, identifying and zooming in on the main areas of due diligence, determining the business case and creating a fully fledged business plan, multiple rounds of negotiations with sellers, getting to know the management team or, if needed, deciding on any changes in leadership, legal documentation, and many others.

Depending on the size and complexity of the transaction, often times a small army is assembled, each with specific expertise and focus, and the onus falls on a small core team to coordinate with all different stakeholders to make sure that each workstream is completed within a strict timeframe. When faced with such high volume of workstreams, it is often easy to overlook some aspects, unless the planning and organization at the very beginning of the process follows a well-structured approach.

We begin our new Termgrid Primers series with a fundamental topic in the capital markets world: the debt financing process. We discuss how it fits into any LBO or M&A process and what are the key questions to consider early on in the transaction.

We aim to help answer some key questions:

- How early in an LBO or M&A process should the process to secure the debt financing start?

- How long does it take to secure debt financing?

- What will lenders be able to provide at every step of an LBO or M&A process?

- How many lenders to include in a debt financing process?

- How early in an LBO or M&A process should the process to secure the debt financing start?

The short answer to this question is <as early as possible>. The more refined answer, which you will hear from your advisors, will be <it depends on the specifics of your transaction>.

Once you have determined debt financing is needed to finance your acquisition, then the conversation and strategy around debt needs to be included amongst the key transaction workstreams. In many institutions, that means involving the dedicated capital markets team from this stage in the process, while in others this is a moment to begin approaching an external (debt) advisor, or merely an additional workstream in the hands of the core team managing the rest of the investment process.

As is often the case, the complexity of a specific transaction is likely to also determine the complexity of raising debt to finance it. However, as stakeholders with a fixed upside, lenders have different priorities compared to equity holders, therefore their analysis of a specific transaction could be very different (more on this in one of our upcoming pieces of this series). Which is why considering the lenders from the very beginning will be crucial in ensuring a successful debt raising process.

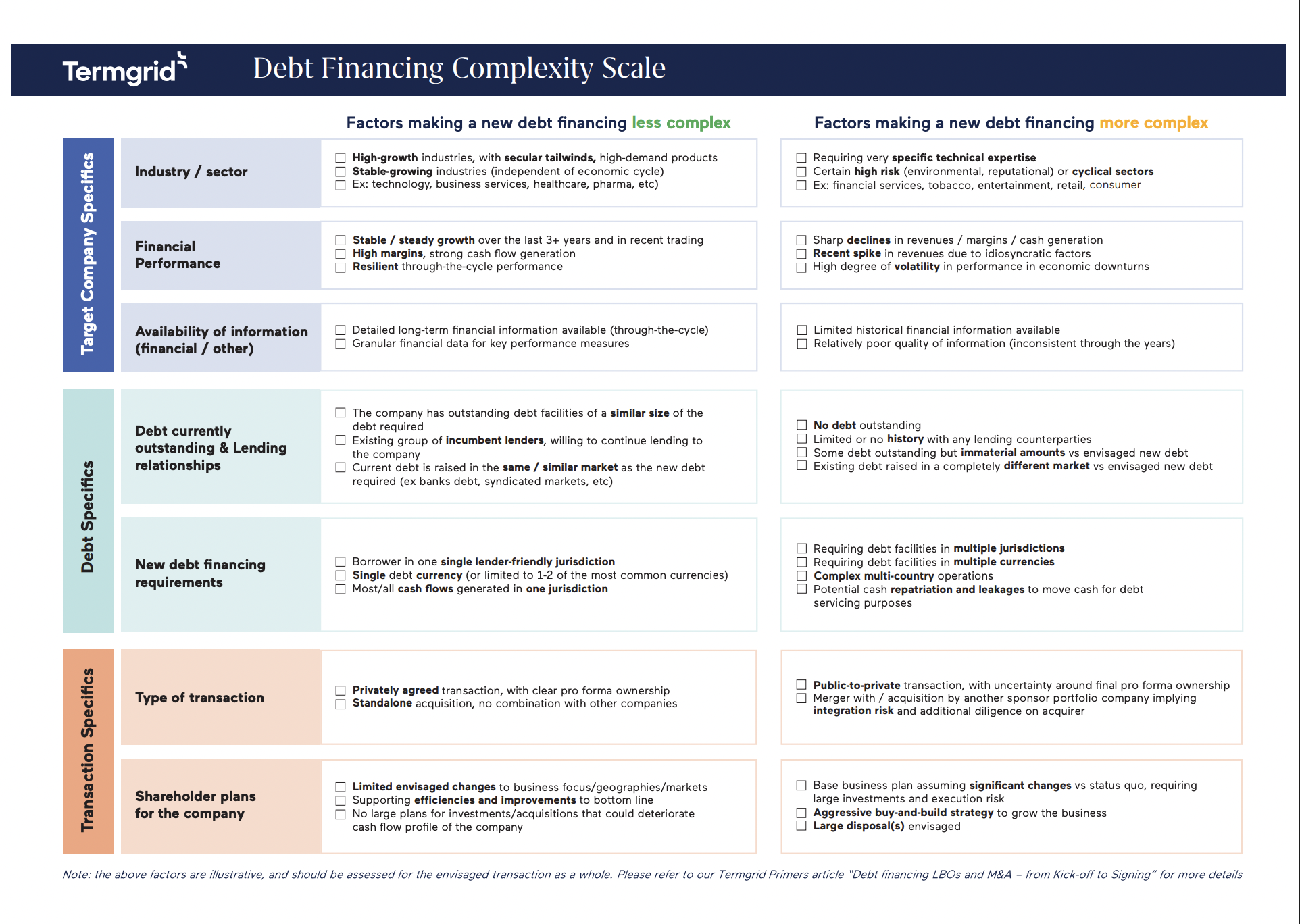

A few factors that would determine the complexity of the transaction from a debt financing perspective are:

- Does the target company have outstanding debt / a group of incumbent lenders? It is, typically, easier to have an incumbent lender group who is already familiar with the business and who would (bar any particular circumstances) likely want to continue their relationship with the target company

- What industry does the target company operate in? There are, of course, sectors that a large range of debt providers are prepared (and keen) to finance (technology, business services, healthcare being top of mind), as well as other more complex sectors either requiring specific expertise (eg infrastructure, real estate, financial services) or involving particular challenges which not all financing providers have a mandate to work with (defence, tobacco, chemicals, etc). When it comes to specific sectors, debt providers also look out for inherent sector cyclicality – generally a high-growth non-cyclical sector with strong tailwinds such as healthcare is much easier to finance compared to one more dependent on the economic cycle such as construction, leisure or entertainment. In this case, though, the specific company positioning will be the key determinant

- How has the target company financial performance been in recent years? While equity holders tend to place more emphasis on future potential, because they are able to directly influence it through strategic changes and enhancements in a business, debt providers are more concerned with past performance. Their focus will be on the last few years of historical performance, the key drivers for that performance (If it was negative – what went wrong?, If it was positive – is it sustainable?), how that fits into the long-term historical performance (think <How did the company do over the last economic downturn?>) as well as the most recent current trading. A company that has had sharp declines in revenues, profitability or cash flows is relatively more complex from a debt perspective. So is a company that has seen a meaningful bump up in headline figures in recent years (eg building materials during the COVID-19 pandemic). The reality always runs deeper than the headline numbers – which is why both the amount and the coherence of the financial information presented to lenders will need to be considered from the very beginning of the due diligence process

- Does the transaction you are currently looking to do have its own complexities? A new standalone LBO financing of a steadily growing company, where the sponsor is looking to support growth and implement efficiencies is a relatively standard story lenders are used to hear in many private equity transactions. However, there could also be factors that add to the complexity of a transaction which they will take into account, some of which are:

- Is the company currently public and are you looking to delist it?

- Why this is relevant: Public-to-private transactions processes and requirements vary depending on jurisdiction. It is, comparably, more straight-forward to lend to a company where the sale is agreed and new ownership is clear upfront, as opposed to a company where ultimate ownership will be determined by the level of acceptance of a tender offer by a large number of public stakeholders

- Does the transaction also involve an acquisition by / merger with another company such as an existing portfolio company of the acquirer (financial sponsor or corporate)?

- Why this is relevant: Mergers and add-on acquisitions involve additional due diligence by lenders and there is always the question of integration risk

- Do you intend to make any major changes in the target company after acquiring it? It could be anything from disposing of large divisions, pursuing an aggressive buy-and-build strategy, to making major changes in the leadership team of the company, or make large investments to expand into new geographies or markets

- Why this is relevant: As a rule, lenders prefer stability. Any major changes which may result in additional execution risk and endanger the company’s ability to service and repay its debt add to the complexity of the transaction

The Debt Financing Complexity Scale:

Click HERE to download.

The above list is not exhaustive, as the complexity of a transaction from a debt perspective is never clear-cut. And, it comes without saying, a complex transaction is, by no means, non-financeable – it only requires more thoughtful planning and targeting of the right financing providers who are able to understand the full circumstances.

The period from 2022 to early 2024 has likely been the most challenging environment to raise debt in over a decade, and a time when lenders were much more risk-adverse towards complex transactions than the years prior. However, and this is perhaps the beauty of the financial markets – in times of volatility, there are always players who step up to provide financing and keep enabling new transactions to complete successfully. In this particular instance, we witnessed the private credit funds stepping up to fill the gap left by public markets who found it often challenging to price risk in light of ever changing rates dynamics. For more about the role of private credit today, we’ve discussed this in detail in our Termgrid Talks series with Marc Chowrimootoo.

- How long does it take to secure debt financing?

As always, the answer to this question is not set in stone, as it depends on the specific circumstances of the transaction you are pursuing.

As a very general rule, for brand new LBO / standalone M&A financings: it could take anywhere from 1 to 6 weeks to secure new debt financing (without considering any syndication timeline or other steps post signing)

What would bring the timeframe closer to the lower end of the range?

- The envisaged debt financing ranks relatively low on the Complexity Scale

- The target company already has debt in place and you do not intend to raise materially more debt than the outstanding amount

- You have one lender / a small group of lenders you work with frequently who are familiar with your institution and documentation precedents, so they are able to move quickly

- You have a full due diligence and information package already finalised, containing most / all information lenders require for their analysis (we will be addressing some specific checklists for a complete lender due diligence package in one of our upcoming articles)

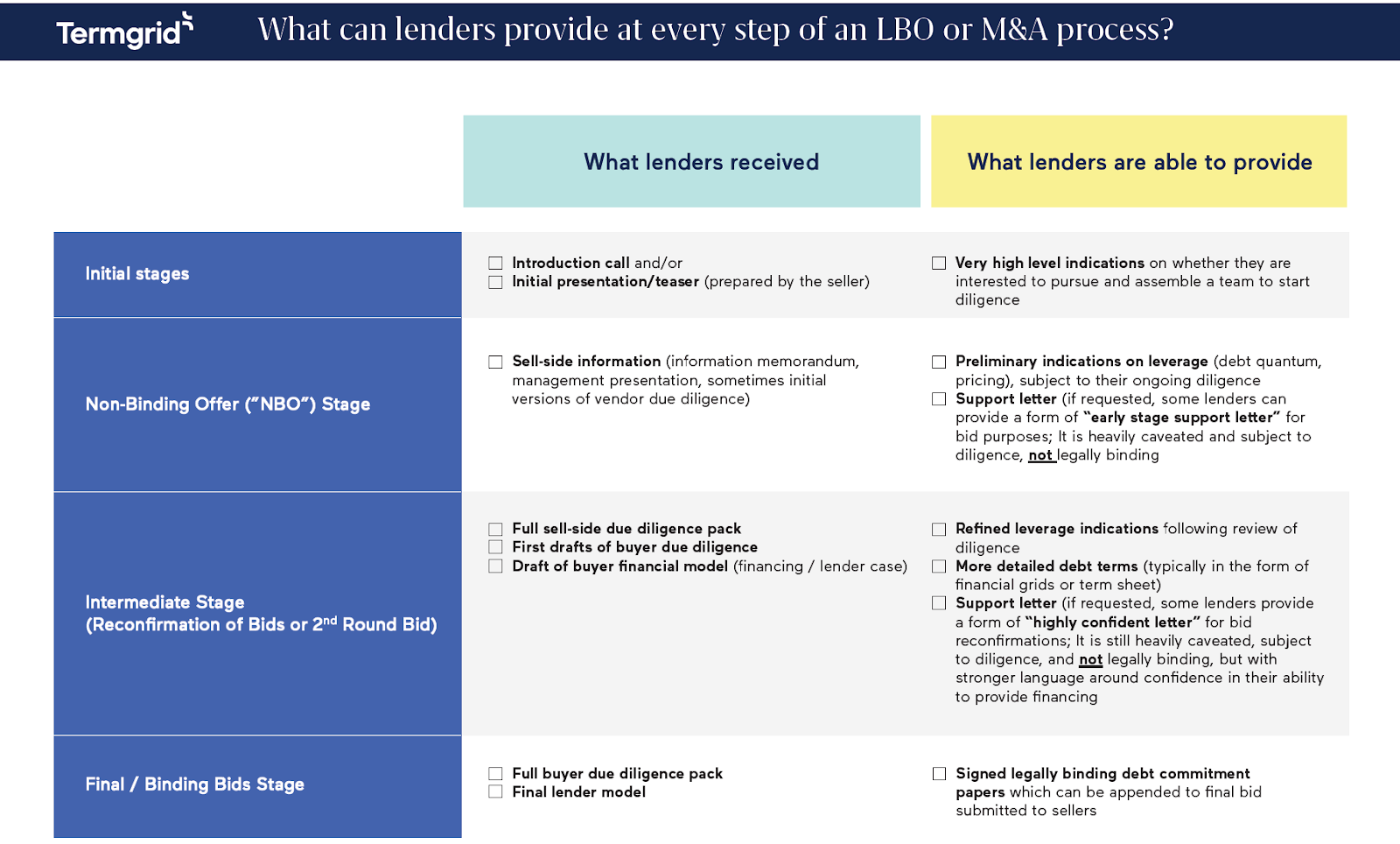

- What will lenders be able to provide at every step of an LBO or M&A process?

While it is important to design the transaction timeline and adjust workstreams (where feasible) to cater for the requirements of debt providers, it is worth keeping in mind what you can expect to receive from your potential debt providers as they work through their internal processes. Whether you are looking at a bilateral transaction, where there is formal exclusivity agreed with the seller, or a competitive auction process, having feedback and outputs from debt providers could be a key factor supporting your ongoing negotiation.

Click HERE to download.

- How many lenders to include in a debt financing process?

This is perhaps amongst the most difficult question to answer, along with <Which lenders should I select?>, as it depends on multiple factors (some already discussed here), specific to each transaction and each institution.

The objective in this case is clearly to avoid the catastrophic situation in which several lenders who have looked at the transaction are not able to provide financing, leaving the buyer with insufficient (or worse, no) debt financing to enable the acquisition. On the flip side, you could also be in the (more positive) situation in which there is too much demand from lenders compared the amount of debt you need to raise, therefore requiring a careful balance between widening the final lending group, scaling back final lender allocations, or eliminating one or multiple lenders from the process altogether – none of which are ideal situations for all parties involved.

Here are a few key questions to ask which would help get closer to an answer regarding the number of lenders, without going into the specifics of selecting actual lender names:

(For simplicity, we are considering a private transaction directly placed with the final lenders, although for a large transaction requiring underwriting by financial institutions many of the considerations are similar)

- How much total debt are you looking to raise?

- Many times this key question will give a quick answer to the overall problem, as you are aware of lender limitations regarding their minimum or maximum ticket appetite

- How many lenders would you ideally have in the final debt package?What is your relationship with the lenders you are planning to involve?

- This requires a careful balancing of the benefits and considerations of having one vs multiple lenders, as well as considering what is feasible for the total debt size you are looking to raise

- Look at existing portfolio companies and their lender composition, as well as how the dynamics have worked in the past as a starting point

- Consider future plans for incremental debt requirements – more lenders means more liquidity for future bolt-on financings

- Where does the deal rank on the Complexity Scale?

- More complex transactions may require a wider outreach process to increase chances of success

- Clearly, a debt financing outreach would need to be tailored to the transaction you are looking at – however, when the timeline is tight, the macroeconomic and geopolitical landscape is volatile, and therefore some investment criteria for lenders may temporarily change or become more selective, casting a wider net in financing processes by involving a larger number of institutions upfront is quite common

- What are the timing constraints?

- You will need to balance the time required to get lenders the information they need vs the overall M&A transaction timeline

- Are there any sensitivities around confidentiality?

- If the transaction is highly confidential and sensitive, sticking to a smaller group might be preferable

Conclusions (TLDR):

The number of lenders invited to a transaction is determined by multiple considerations, including total debt requirement, transaction complexity, confidentiality, timing constraints, etc

Planning for the debt financing workstream should begin as soon as you have determined you will need debt to finance the acquisition you are envisaging

Anywhere between 1-6 weeks is required to put debt in place. Ultimately, it will depend on overall complexity of your transaction and multiple other general or idiosyncratic factors

Kicking off a debt process early will be beneficial to the overall transaction, especially during a volatile macroeconomic environment

How Termgrid can support you

Termgrid provides optimal tools that enable our clients to streamline their debt financing activities and drive strategic insights through a centralized transaction data platform. Our Deal Execution platform helps execute and manage financing transactions end-to-end, enabling, amongst other functionalities, efficient file sharing with multiple institution at the touch of a button.

The Termgrid platform is currently powering the capital market activities of 50+ sponsors from large cap to small cap. We are helping firms without dedicated capital markets professionals save time and money on processes while building institutional knowledge.

If you’d like to hear more, get in touch with our team or schedule a demo here.

Stay in touch with all of our latest updates and articles. Sign up now.