Private credit managers buy, build & partner to get a foot in asset-based finance

Private credit managers are continuing to move in on bank lending territory, and the latest target in their sights is asset-based financing.

While private credit has become increasingly popular over the last few years, it has been dominated by direct lending, which is primarily cash-flow based. There are still relatively untapped parts of the market, where investors have recently started to turn to in search of increased returns and more protection.

One such area is asset-based lending, which has seen the giants of alternatives, from KKR to Apollo Global Management, take a keen interest over the last year in particular.

One of the drivers of the rise of asset-based lending have been sponsors, who, due to the increased cost of debt because of higher interest rates, have been unable to finance their acquisitions. They have become more creative in looking for financing and a survey conducted by Investec in 2024 found that 48% of GPs were seeing ABL as their second or third choice.

If a borrower is asset-rich, this type of lending can be lower-cost and allow the sponsor to increase the leverage. And because the assets are put up as collateral, it limits the risk for the lender, which can be particularly attractive at a volatile time for businesses with cash-flows coming under pressure. Compared to other parts of the private credit market, it is still less crowded, meaning that there is a greater opportunity set for credit managers.

There are a few different strategies private credit managers are employing to tap into this market. The first is setting up their own strategies.

A Preqin survey found that 58% of private credit managers were going to prioritise an ABL strategy this year and five of the top 30 private debt managers in the US had already launched a dedicated fund in 2024. These include Apollo, which launched a semi-liquid fund called the Apollo Asset Backed Credit Company; and Oaktree Capital, which is targeting $2bn for its ABL vehicle.

In addition, private credit managers are partnering with banks, which continue to de-risk their balance sheets.

For example, Barclays sold $1.1bn of credit card receivables in the US to Blackstone, while BNP Paribas announced a $5bn investment to support investment-grade, asset-backed credit originated by Apollo and ATLAS, the warehouse finance business majority owned by Apollo’s funds.

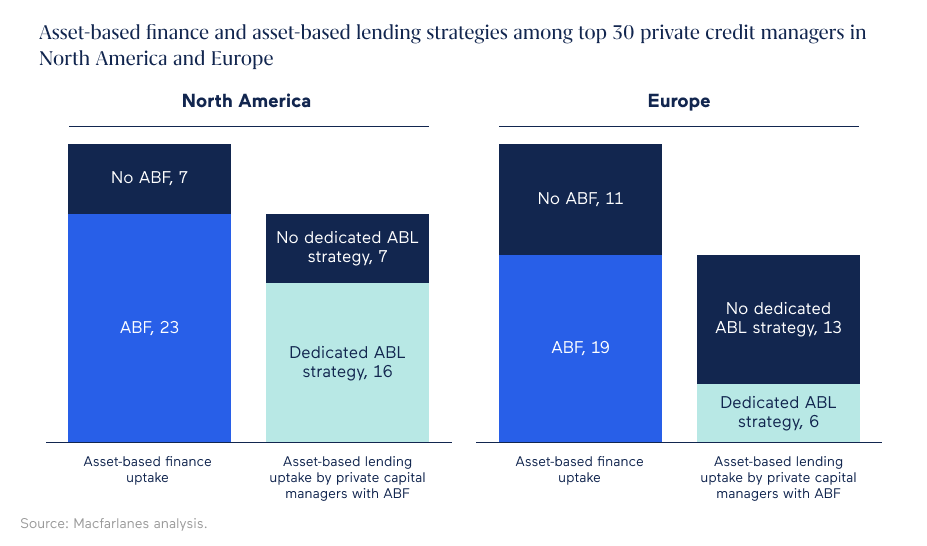

There are many other examples including firms like Ares, Pemberton, Carlyle and PGIM. So far the growth in the market has been focused more on the US. An analysis by Macfarlanes discovered that of the top 30 private credit managers in North America, 23, or 77% engage in ABF. Of those, 16 have a dedicated strategy. In contrast, 19 out of 30 managers in Europe have an ABF strategy and only six of those have a dedicated strategy.

And finally, firms are acquisition specialists, such as in the case of Janus Henderson purchase of Victory Park Capital or Blue Owl’s acquisition of Atalaya Capital.

Estimates suggest that the ABF market is around $6tn currently, with many expecting it to grow to around $10tn by 2028.

And while the demand is there, challenges for firms remain.

First of all, asset-based financing can be much more complex and needs the right technology so firms can accurately and efficiently manage the collateral, automate repetitive tasks and boost the risk management on investments.

There is also legal complexity around recovery of assets in the case of a default. Working through these processes can take time and resources and can impact recovery rates. Lenders will need to think about such risks during the origination process and structure the loans accordingly.

“Managers should not underestimate the complexities and challenges involved in legal proceedings to recover assets pledged as collateral in the event of default. The associated costs, potential delays, and legal hurdles can significantly affect the net recovery value,” explained Margarida Ferreira, Investor Intelligence Lead, Macfarlanes.

“These factors should be carefully accounted for during the loan origination process when determining the advance rate. A thorough understanding of relevant laws and regulations – such as asset registration requirements, the hierarchy of creditor claims, and enforcement procedures – is essential to mitigate risks and maximise recovery outcomes.”

Stay in touch with all of our latest updates and articles. Sign up now.