In financial markets terms, private credit is still a new and emerging asset class. As such there is relatively little academic research on it.

We are indebted to the academics who pursue research in this area. By its very nature, this market is private. So there would undoubtedly be easier parts of the financial system to analyze. This makes the research even more valuable.

1. Deals are sourced and evaluated differently in the US and Europe

This insight is drawn from a seminal study of private debt funds completed by Joern Block and Anna Schulze of the University of Trier and Young Soo Jang and Steven Kaplan of the University of Chicago Booth School of Business.

The study was conducted in 2021 and completed in 2023.

US investors largely rely on sponsors for their dealflow while European investors source from both sponsors and independently. This finding is based upon first hand responses from private debt funds in both regions and shows that U.S funds invest significantly more of their capital in PE-sponsored deals, 78%, compared to European funds at 41%.

The study also looked at the factors taken into account as part of the investment decision. It found that while stable cash flows play an important role on both sides of the Atlantic, there are differences in priorities.

US managers prioritize stable cash flows over the management team and business model (although the management team is also important to them), whereas European managers are more like PE investors and consider the management team, stable cash flows, and business model to be roughly equally important.

According to the authors, the two findings may be related. The presence of private equity sponsors in US deals may exert a stabilizing influence on these companies and provide comfort on any questions relating to management or the business.

The study goes on to look at the relationships between private equity sponsors and debt investors. Investors – particularly in the US – find that the presence of a sponsor helps with deal quality and deal sourcing.

It also helps with reduced costs. Sponsors and lenders build relationships based upon multiple interactions. Which results in more effective covenants and a willingness to lend at higher multiples.

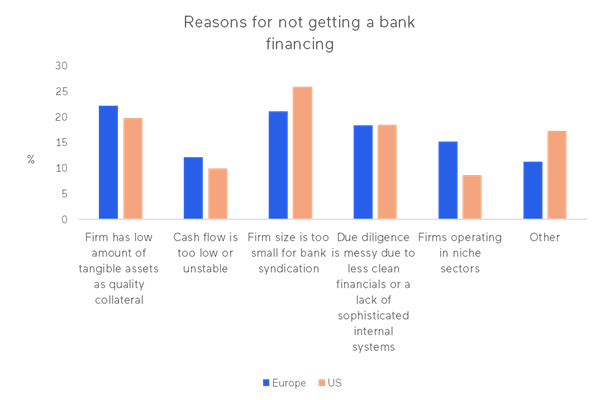

This is an extremely valuable study which reflects first person responses from the private debt community. Among the many other findings in the study, it goes on to look at the valuable role that private debt plays – including providing financing where companies may not be able to access bank financing.

Source: A Survey of Private Debt Funds

Please note that answers are drawn from respondents who identified portfolio companies that would not be able to access bank financing and participants were allowed to choose multiple answers.

You can read the full report here.

2. Strong relationships between sponsors and lenders enable them to support companies in distress

This is drawn from a January 2024 report, Are Direct Lenders More Like Banks or Arm’s-Length Investors? by Young Soo Jang of Chicago Booth Business School. The research encompassed the Covid pandemic, offering a unique insight into how direct lenders manage companies experiencing distress.

With access to a unique database of direct loans, the author was able to identify companies that had violated a covenant between January 2016 and March 2021.

Young soo read individual loan agreements and identified that 77% of covenant violations with direct lenders resulted in tighter covenants, negative covenants or other terms. This compares to 67% of bank lenders.

So direct lenders do exert control over borrowers – at least as often as banks.

How would this relationships work during a period of stress? The report identifies that the probably of payment deferral for direct loans was 25%, compared to 9% for bank loans.

Direct lenders are also less likely to enforce bankruptcy proceedings (3%) compared to 14% for bank lenders.

However this apparent flexibility is not without other protections. Direct loans are more likely to see an equity injection from a sponsor (40% vs 23%) and a lower likelihood of exit (11% vs 23%).

So lenders can offer flexibility during times of distress but this is likely to be based upon the continued – and even increased – role of a sponsor in the borrower company.

So the relationships between a sponsor and direct lender doesn’t just stop at deal sourcing, that relationship continues and is influential through the life of the loan – including during periods of distress.

3. Private credit is driving a new form of debt governance

The most recent of our academic papers is by Narine Lalafaryan of the University of Cambridge and looks at the influence of private credit funds compared to traditional bank lending. The full report is entitled Private Credit: A Rennaissance in Corporate Finance and can be read here.

Private credit has grown into a long term, relational type of finance and what this means for the emerging concept of debt governance which is increasingly important outside of financial distress.

Historically lenders exerted control through covenants. Private credit has evolved in line with a market-driven approach within the context of the evolving nature of debt finance.

Direct loans are made on a long term basis and include a premium for the illiquid nature of the investment. The bilateral basis of the relationship sets the scene for more cooperation between the borrower and lender.

The floating rate of interest associated with direct loans offers an inbuilt platform for that relationship. With regular repricings, debtholders engage with the borrower on a regular basis – long before there are any signs of distress.

Private credit funds may also have board representation and relationships with management. Contractual provisions such as minimum return or carried interest as well as the long term nature of the loan, bring closer alignment between debt and equity holders.

The end result is that private debt providers are interested in profit maximization at a borrower firm and are likely to be actively engaged in the governance of the firm outside of financial distress.

Relationship finance is back.

We would like to thank the authors of these reports for their permission to cite these reports. Each one contributes enormously to the learning around private credit and its contribution to businesses globally.

Stay in touch with all of our latest updates and articles. Sign up now.