Exclusive data lifts the lid on challenges facing dealmakers as January market lifts off

Termgrid has released exclusive data showing that deal timelines lengthened 56% in Q4 2023. Termgrid’s end to end platform is used by sponsors, lenders and advisors to support private capital workflows and the data reflects deals closed, dropped or lost in Q4 2023.

The data follows on from an exclusive private capital survey released in January showing that market participants believed deal timelines were extending (62%) and attributed the delay to a mismatch of price expectations (59%).

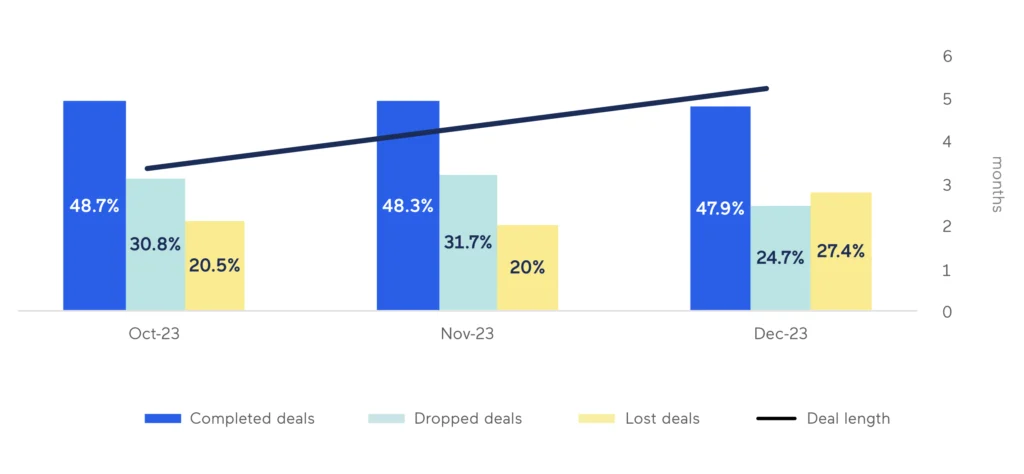

The chart shows a percentage of all the deals closed on Termgrid’s platform. While the percentage of completed, dropped and lost deals varies slightly – it is in line with broad trends over time. The secondary axis shows deal timelines presented as a three month historical figure with the weighted average rising from below 3.5 months in October to over 5 months in December.

For small, highly specialized teams working on multiple deals this type of increase can be painful.

While we understand that there may still be a mismatch of price expectations in M&A, the new year has brought a fresh wave of activity and optimism to the private credit market. The drivers of this include new budgets, desire to deploy capital and pressure on GPs to deploy capital and return funds to LPs.

“Against a difficult backdrop of nominal activity in the last two years, 2024 has been fast out of the block. In addition to strong activity we see on the Termgrid platform, price compression and refinancings are leading indicators of a strong year for private credit,” said Dipish Rai, co-founder and CEO, Termgrid.

“We are delighted to work with all of our private capital community to drive efficiencies throughout their financing processes and portfolio management. Even in changing market conditions, deals can be executed seamlessly using our platform.”

Stay in touch with all of our latest updates and articles. Sign up now.