We are delighted to announce Termgrid Primers, a new series focusing on basic topics on the debt financing process.

Written by Leveraged Finance and Capital Markets professionals, Termgrid Primers will focus on practical tips and best practices for executing, coordinating and closing debt deals in the sub-investment grade space.

We are delighted to share the full article below. However, if you would like to fill in the form we will email you with the full report to read at your leisure.

Signing up will also ensure that you get emailed directly with all of the following episodes.

Series 1: The Debt Financing Process

Episode 1.3: The choice of a debt instrument

In our prior episodes, we’ve gone in depth through the debt financing process, timeline and information required by debt providers in their due diligence. Today, we dive into another fundamental aspect, a key decision that profoundly impacts a company and its owners: the process and key questions to address when selecting a debt instrument.

As a reminder, throughout the Termgrid Primers series our focus is on the sub-investment grade debt market, where the vast majority of private-equity backed transactions are financed.

Choosing the most appropriate market and debt instrument is a decision made most often by financial buyers when they first enter an investment. Since debt represents a sizeable portion of the capital structure, this decision will have an effect on the way a company will be run. Therefore it is important to select an instrument which adequately caters to the business and the shareholders’ requirements.

We address the following topics in today’s article:

- The main types of debt instruments used by private-equity owned companies

- Public vs private markets – is there an optimal choice?

- Key items to consider early on which will help narrow down the debt instruments available

- The main types of debt instruments used by private equity-owned companies

The sub-investment grade market has grown and developed significantly over the last decades. It has gone from a relatively niche market in the 1980s and 1990s, to a separate and significant asset class within fixed income. For a while, both before and after the Global Financial Crisis, the market was essentially synonymous with public credit markets which include high yield bonds and broadly syndicated loans (“BSL” or leveraged loans). In the last few years, however, private credit has seen exponential growth and is now a real contender to public markets.

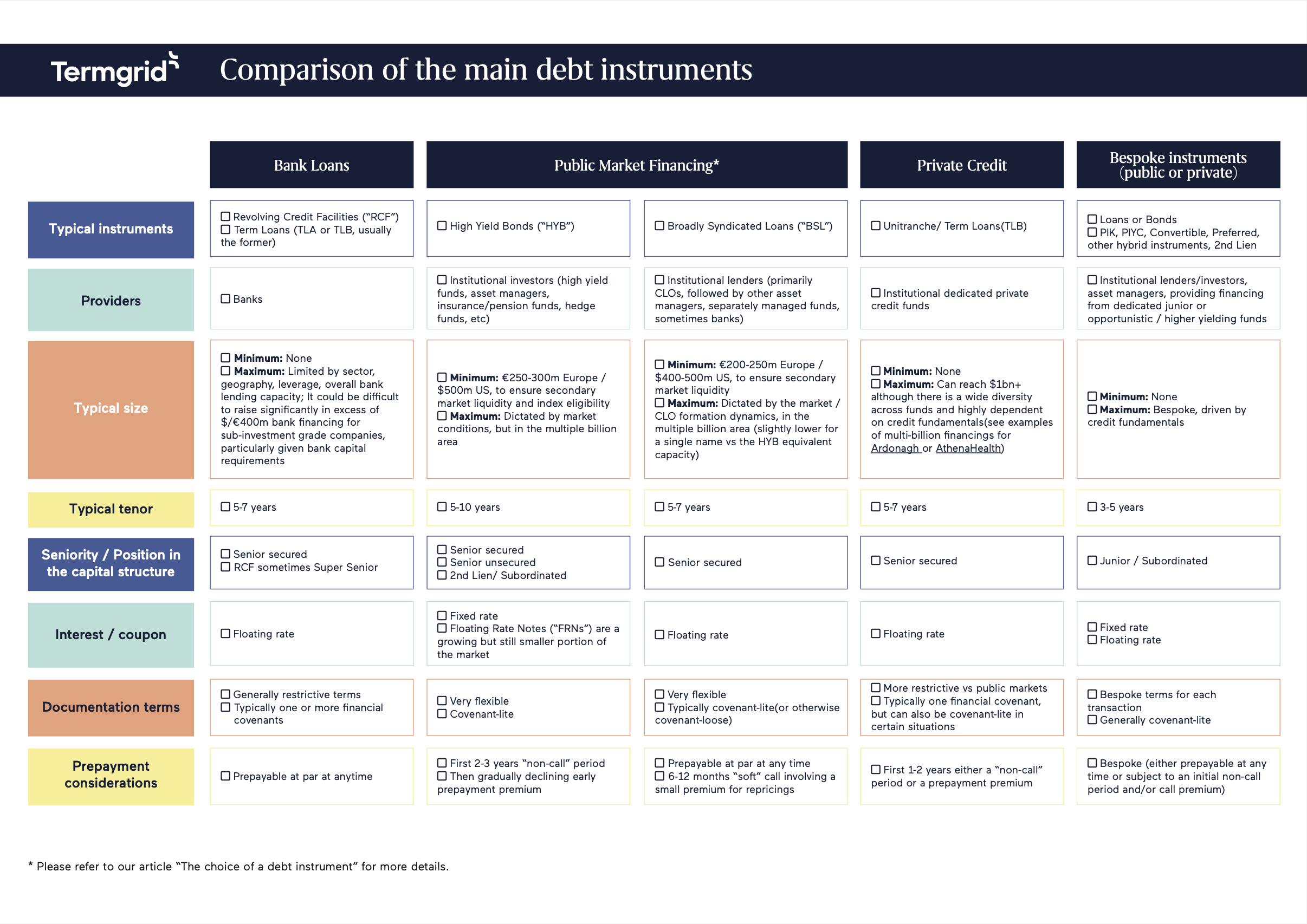

There is, therefore, quite a lot of choice for the debt financing of private equity-backed companies. Each instrument has specific features, advantages and limitations, which should be closely considered when the debt package is first put in place.

- Bank financing: Although the leveraged market has gradually diversified away from bank financing ever since banks started facing more punitive capital constrains during the financial crisis, banks continue to provide financing to private-equity owned companies in multiple forms:

- Revolving Credit Facilities (“RCF”): They are the main credit lines used by corporates of all sizes to manage day-to-day working capital and liquidity requirements, although their use has also expanded over the years to finance capital expenditures or M&A and “general corporate purposes”, covering a very wide range of uses. As the drawn debt tranches have gradually shifted to non-bank lenders, the RCF remains a staple product primarily provided by banks, also seen as the most “relationship-driven” part of the capital structure.

- Bank Loans: The traditional bank product, while still present in the leveraged / sub-investment grade market, is not the prominent product offered by banks today, particularly in larger deals where bank capital requirements are a significant limiting factor overall capacity. Bank-led deals continue, however, to represent a sizeable portion of debt financing for the middle-market and lower-middle-market transactions, where the total financing requirement is still relatively small (below $200m-equivalent) or where there are local/regional/national incentives for banks to support small and medium companies in the areas. These facilities will include some traditional bank features, such as amortization, one or multiple financial covenants, as well as more stringent documentation terms – many of which are seen as quite punitive, particularly compared to the alternative sources of financing available to sponsor-owned companies.

- Revolving Credit Facilities (“RCF”): They are the main credit lines used by corporates of all sizes to manage day-to-day working capital and liquidity requirements, although their use has also expanded over the years to finance capital expenditures or M&A and “general corporate purposes”, covering a very wide range of uses. As the drawn debt tranches have gradually shifted to non-bank lenders, the RCF remains a staple product primarily provided by banks, also seen as the most “relationship-driven” part of the capital structure.

- High Yield Bonds: They represent a standardized, long-term debt financing instrument, offering companies access to public fixed income markets. High yield markets stepped in for banks and redeemed their place as a significant source of alternative debt financing after the Global Financial Crisis. They are the only wide-spread debt instrument with a fixed interest or coupon (a particularly key point in a rising rate environment), although floating-rate bonds (more commonly known as Floating-Rate Notes or “FRN”s) have seen increased interest in recent years. Before issuing a high yield bond, a company must find the right balance between putting in place an instrument with very attractive and flexible documentation terms, and ensuring they are prepared to meet the more stringent requirements of a publicly issued security (including historical audits, public reporting, credit ratings, amongst others). It is an instrument of choice particularly in large transactions, given the significant depth of the market.

- Broadly Syndicated Loans (“BSL”) or Leveraged Loans: The BSL emerged as the institutional market’s alternative to bank loans, sitting at the intersection of public and private markets. The continued growth of Collateralized Loan Obligations (“CLO”) vehicles has been a significant driver of the growth of the BSL market, as CLOs represent well over half of the sources of funding for leveraged loans. Over the years, the documentation terms for BSLs have gradually loosened, and are now broadly similar to the highly flexible high yield bond terms, making them the most popular product to finance private-equity owned companies, with a key advantage over bonds being the lack of a prepayment premium which grants sponsors significant flexibility. Leveraged Loans are not public securities (even though there is an active secondary market for them), and therefore do not have many of the strict requirements that high yield bonds impose on their issuers, although some items such as credit ratings are key requirements to satisfy CLO investment criteria.

- Private Credit: The youngest and fastest growing segment of the leveraged credit space, private credit has been in the spotlight for the last few years. Only a few years prior to this, it was considered the financing option for companies who were too small to access either high yield bonds or leveraged loans. The asset class saw a surge in demand during the 2022-2023 market disruption, and emerged as a reliable source of financing during volatile times in public markets. Documentation terms and economics have historically been less attractive compared to public market alternatives – with an important difference being the requirement for a financial covenant and wider pricing. However, as the private credit market has continued to grow and become more competitive, documentation terms have continuously been improving in the borrowers’ favor and gradually converging to very similar terms to the ones achievable in public markets. When looking to raise new debt in the range of $400-1,000m, companies are now closely considering the benefits and considerations of both public markets and private credit – and the decision is not always entirely obvious from the onset!

- Other Bespoke Solutions: In addition to the instruments already mentioned, which are generally structured as traditional senior debt, there are also more complex (and often times more costly) instruments which are designed for particular company requirements. These instruments are typically junior or subordinated, and can be put in place on top of one or more senior instruments. They can take multiple non-standardized forms including PIK (payment-in-kind), PIYC (pay-if-you-can) or hybrid (convertible debt, debt with warrants attached) features – all of which are designed in partnership with the borrowers and shareholders, who may be looking to increase leverage, while keeping cash interest low at the operating companies. Given their bespoke and private nature, these are typically bilateral facilities provided by a single lender (or a small group of lenders in case the facility is of a significant size).

Summary features of the main debt instruments in the Leveraged Finance space: CLICK to download.

*See section B) for how we categorize public vs private markets for the purpose of this discussion

Sources: Ardonagh (2024), Athenahealth (2019)

- Public vs private markets

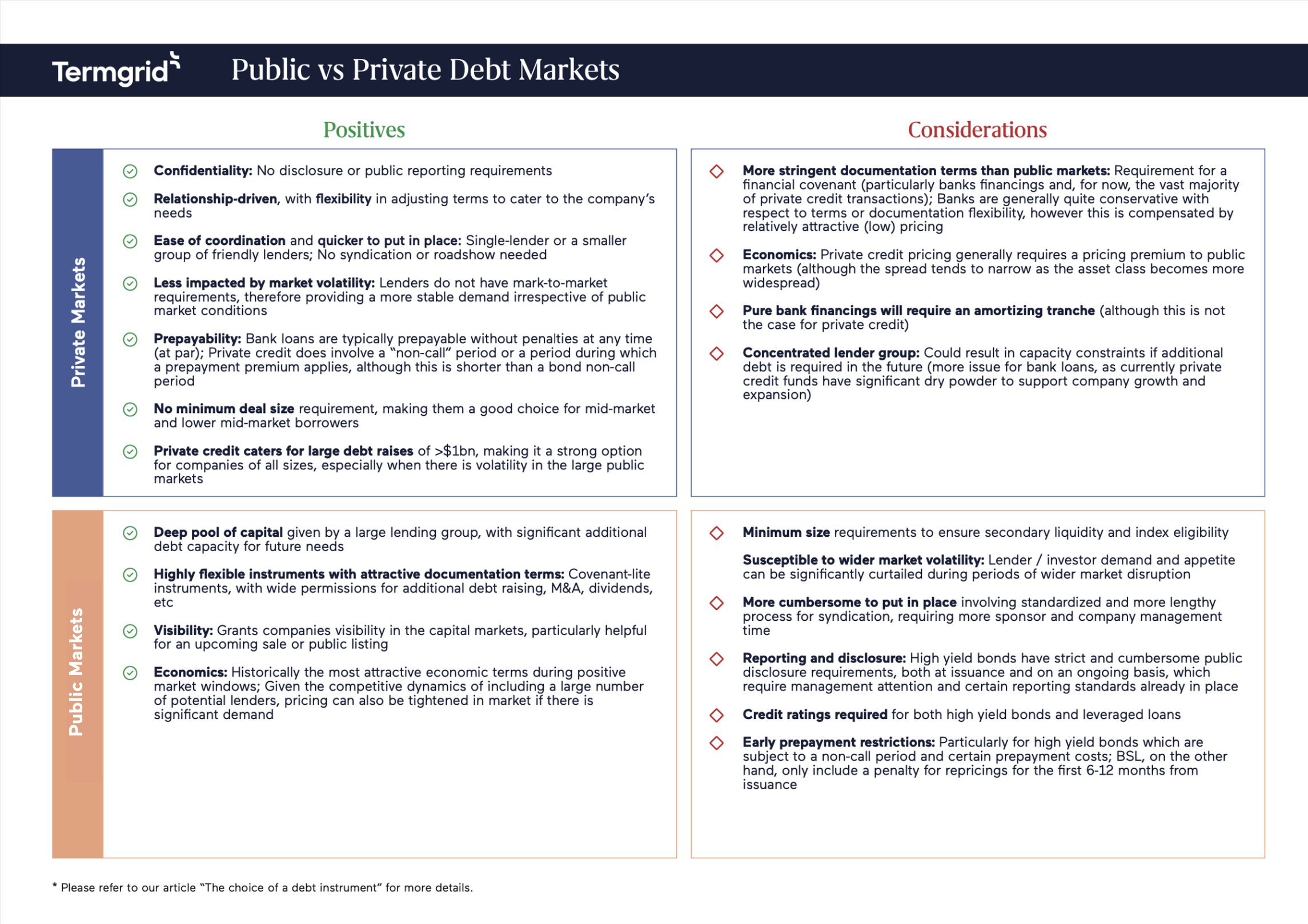

As we have already introduced the distinction between public and private market debt instruments, let us dive a bit deeper into the differences between the two markets where debt can be raised.

In the sub-investment grade space, we typically categorize instruments as follows:

- Private markets:

- They include any debt facilities placed privately with one or multiple lending parties, whereby the terms of the transactions are typically not (widely) disclosed. Generally, the lenders tend to hold the debt to maturity (or until it is repaid), meaning there is no active secondary market for the debt to trade. That said, there could be certain secondary transactions between lenders during the life of the debt facility, for various reasons, but only under certain strict transfer restrictions regulated in the credit agreement.

- Private market debt instruments: bank loans, private credit

- Public markets:

- Public markets technically include those debt facilities which are publicly announced at issuance, listed on a public exchange, and for which there is an active secondary trading market. There is, however, a middle ground represented by leveraged loans. These are not listed on an exchange, however they are widely traded in the secondary market through dedicated trading desks (although they do not qualify as public securities)

- Public market debt instruments: high yield bonds and broadly syndicated loans (“BSL”), with the latter representing more of a middle ground

We have laid out a few considerations for both private and public markets below. The idea is not to determine a clear best choice, as that is impossible, but instead to provide multiple perspectives into the main advantages and drawbacks from choosing between these two markets.

Overall, the decision will come down to the specific sponsor and company circumstances: CLICK to download

- Key items to consider early on

In addition to understanding the main features, benefits and limitations of each instrument, which we covered in the previous sections, it is important for buyers to also have clarity on a few other fundamental aspects which will help narrow down the debt financing options.

All these are aspects which are relevant for the overall investment, whether you are at the entry stage, or a few years into the respective investment.

| Size: |

|

| Investment horizon: |

|

| Investment thesis and the growth plan for the company: |

|

Conclusions (TLDR):

- There are multiple debt instruments available in the sub-investment grade space, split across private and public markets, each with their specific advantages and drawbacks

- Choosing a debt instrument is a very important decision made very early on into an investment – therefore knowing the different options available is key

When choosing a debt instrument, one needs to take into account the overall investment horizon as well as future plans for the company, as this will determine the right structure and flexibility required in the future.

How Termgrid can support you

Termgrid provides optimal tools that enable our clients to streamline their debt financing activities and drive strategic insights through a centralized transaction data platform. Our Deal Execution platform helps execute and manage financing transactions end-to-end, enabling, amongst other functionalities, efficient file sharing with multiple institution at the touch of a button.

The Termgrid platform is currently powering the capital market activities of 50+ sponsors from large cap to small cap. We are helping firms without dedicated capital markets professionals save time and money on processes while building institutional knowledge.

If you’d like to hear more, get in touch with our team or schedule a demo here.

Stay in touch with all of our latest updates and articles. Sign up now.