Welcome to Lender Lens, our series for profiling leaders in the Lender community. With private credit playing an increasingly important role in the financial system, we wanted to find out how lenders are navigating the evolving landscape and how they assess the market...

Purpose built technology for debt finance

Insight and efficiency across the debt lifecycle

Arrange new debt finance with speed and precision

From dashboard to data room, Termgrid is built for every stage of the debt financing process. Launch your deal in minutes with institution-specific NDAs, manage due diligence in a tailored data room, and move seamlessly through to term sheets.

Collaborate with advisors, monitor lender engagement and manage tasks in real time from a powerful, intuitive dashboard.

Interested in Our Term Sheet Capabilities?

If you would like to find out more about our market-leading functionality for term sheets, please request our FAQs document here.

Drive performance on your debt portfolio

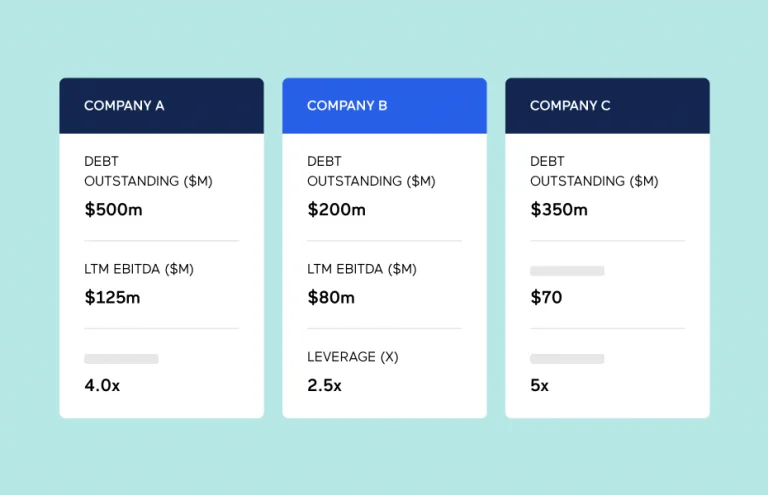

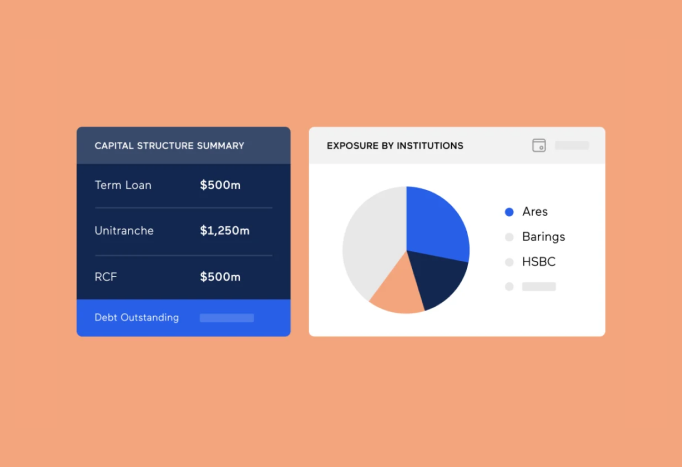

If you are still tracking leverage, covenants and amortization schedules across excel spreadsheets or clunky systems – there is a better way. Termgrid’s Portfolio Management system is designed exclusively for the debt process.

Access real-time insights into your Capital Structure, Covenants, and Financials—so you can make informed decisions with confidence.

Customer Stories: Real Results from Real Teams

![deal execution [Case Study] Sponsor deal execution | Termgrid](https://app.termgrid.com/wp-content/uploads/2025/05/deal-execution-1.png)

European PE firm saved 90%+ time on NDAs, data sharing, and lender negotiations with Termgrid’s deal execution platform. Read case study.

![fund finance [Case Study] Sponsor Fund Financing | Termgrid](https://app.termgrid.com/wp-content/uploads/2021/11/fund-finance-1.png)

Learn how a global PE firm used Termgrid to securely share fund-level data and streamline deal execution with full visibility and control.

Precedent terms for smarter negotiations

Drill down into your precedent terms. Powerful search functionality across documents and deals to generate real-time insights.

Digitize your institution’s precedent terms to enable better decision-making and negotiations.

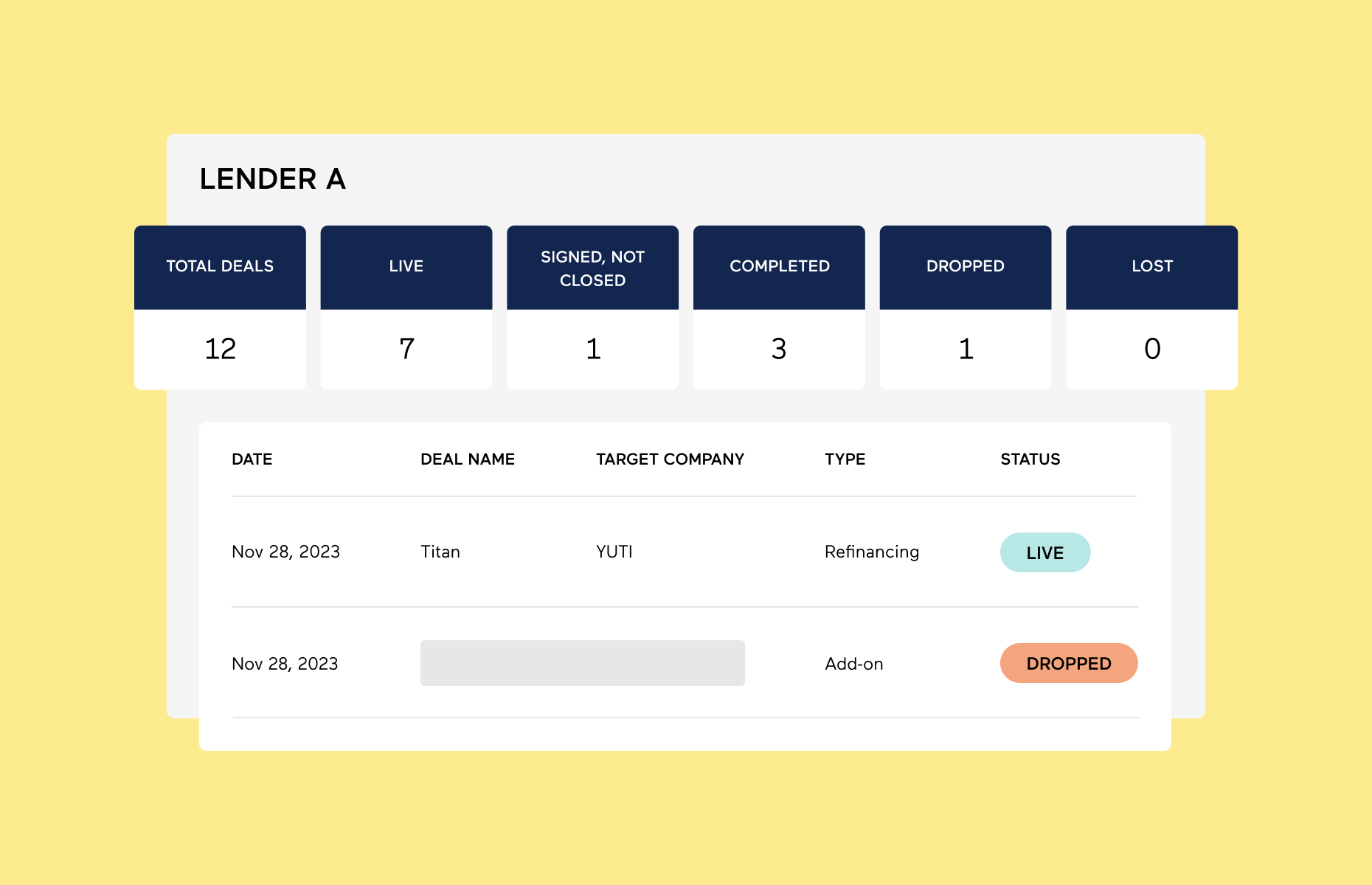

Strategically manage lender relationships

Relationships are the heart of your business. Traditional CRMs are not designed to track lending relationships, so you could find yourself dealing with inefficiencies and missed insights.

Termgrid’s Relationship Insights is automatically populated from your debt deals and portfolio, giving you a complete, real-time view of every lender interaction—without the manual data entry.

Meet New Lenders

Duncan Browne, Kartesia

Welcome to Lender Lens, our series for profiling leaders in the Lender community. With private credit playing an increasingly important role in the financial system, we wanted to find out how lenders are navigating the evolving landscape and how they assess the market...

David Wilson, 17Capital

Welcome to Lender Lens, our series for profiling leaders in the Lender community. With private credit playing an increasingly important role in the financial system, we wanted to find out how lenders are navigating the evolving landscape and how they assess the market...

Top Resources

In Private with Akshat Khaitan, KKR Capital Markets

In this episode of Termgrid Talks, Dipish Rai spoke to Akshat Khaitan, Managing Director, KKR Capital Markets in late 2024. KKR’s unique position in the market – borrower, lender and with underwriting capabilities – offers an interesting vantage…

Termgrid Primers – Your Playbook for Navigating Debt Transactions

Termgrid Primers is a series by industry experts covering core topics across leveraged finance, capital markets, and legal workflows to help you navigate and execute debt deals with confidence.

Ready to get started?

See how we can optimize your financing workflows